Africa Payroll Solutions

Do business all over Africa with our multi-currency payroll software.

PaySpace Africa Payroll and HR offers local or expatriate multi-country, multi-currency and multi-language payroll solutions for 40+ African Countries.

The PaySpace Africa Payroll and HR Software provides customers with a 100% cloud-native Payroll and Human Capital Management System with built-in, up-to-date, country-specific legislation and compliance.

Global Access to Data

Whether payroll is being processed from a central location, local offices or completely outsourced to PaySpace, our payroll software is accessible to all types of users who have internet access and a browser, via any device.

If the local offices are processing the payroll, head office will have complete transparency and report capability via direct access to the system.

Payroll processing at head office level also allows local users to draw reports for review purposes, and print payslips for distribution – directly from PaySpace.

Robust Reporting

Using a single platform greatly simplifies reporting through PaySpace. Extensive General Ledger extracts for all leading foremost and local accounting systems are available.

A host of standard, real-time reports covering Payroll, HR, Costing or Legislation are accessible in various formats. PaySpace also offer a powerful cloud analytics (Business Intelligence) tool that provides users with a flexible toolset to analyse data quickly and easily.

Easy to Use

Our payroll and HR software greatly simplifies the input of all data via either manual capture, workflows or bulk uploads using standard Excel spreadsheets or by interfacing directly to a customer’s HRIS or ERP platform using our powerful web services.

African Tax Compliance

Through our extensive network, PaySpace ensures local tax compliance and accuracy for any payroll – including tax calculations, required in each of the 40 countries.

We understand and adhere to all necessary monthly and tax year-end processes and ensure all components of compensation are automatically included in the Payroll and HR System. The PaySpace software also provides country-specific legislative reports for submission purposes.

Need assistance with your payroll?

PaySpace offer a professional Payroll Outsourcing Service for any size business or industry across Africa. Our payroll specialists can assist any company with monthly, bi-weekly or weekly payroll services.

Even though PaySpace manages payroll, clients will still have direct access to the system, at any point, to view and manage employee data. All data is securely sent and received via PaySpace’s online Cloud Room to avoid any security breaches that may occur during an email process.

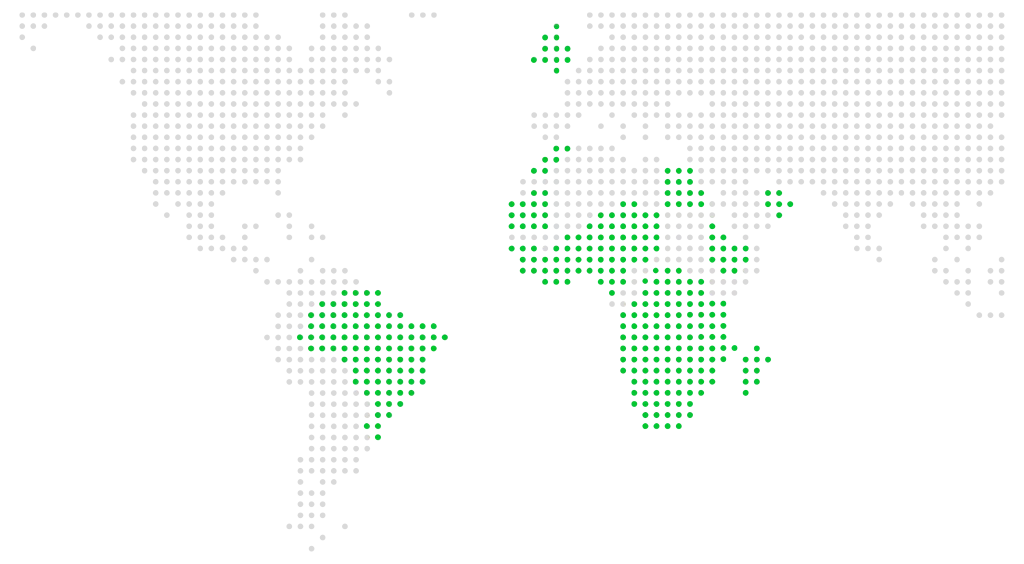

Global Footprint

Full Legislative Delivery Countries

This includes all automated statutory calculations and reports. PaySpace carry the costs of confirming and updating all legislative changes by following our 5 tier advisory approach. These countries are regularly checked and audited by the PaySpace compliance team. We also update these countries public holidays and medical aid tables.

- Angola

- Benin

- Botswana

- Brazil

- Burkina Faso

- Burundi

- Cameroon

- Chad

- Congo

- Democratic Republic of Congo

- Egypt

- Equatorial Guinea

- Eritrea

- Ethiopia

- Gabon

- Gambia

- Ghana

- Guinea Conakry

- Ivory Coast

- Kenya

- Lesotho

- Liberia

- Madagascar

- Malawi

- Mali

- Mauritania

- Mauritius

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Rwanda

- Senegal

- Sierra Leone

- South Africa

- Eswatini

- Tanzania

- Togo

- Tunisia

- Uganda

- United Arab Emirates (UAE)

- United Kingdom

- Zambia

- Zimbabwe

Strategic relationships with various highly-acclaimed accounting firms across Africa have been set-up to ensure the best possible solution and 100% legislative compliance in any African country. Together with multinational specific functionality, PaySpace provides powerful delivery that assists clients in rolling out into international regions rapidly.

Become the master of your payroll

Key Benefits of the PaySpace Africa Payroll and HR

Automated maintenance of country-specific legislative rules

Ability to house various date valid currency conversion rates for calculations and reporting

Accruals are based on the length of service, grade based, or a combination of both

Advanced Expatriate Functionality

Multi-component gross up functionality

Tax management reporting of Year To Dates (YTD’s) for home country tax purposes

Single Company, Multi-Currency Options

Enterprise-wide visibility using Cloud Analytics

Multiple-integration touch points

Powerful Mock Payslip feature – test different “what if” scenarios

Language specific payslips

Effortless country to country transfer processes

Self-Service – Employees can access their info at any time on any device

Accessible World Wide

How global payroll can boost global business?

Managing a business on a global scale presents many operational challenges, not least of which is payroll.