Support Monthly Newsletter

Support Monthly Newsletter

A quick reference page with the latest news, tips and tricks from the Deel Local Payroll Customer Support Team.

Annual Reconciliation Declaration (EMP501)

Congratulations to those who have successfully completed their Annual Reconciliation Declaration Submission. If you haven’t submitted yet, we’re here to help.

Please don’t hesitate to contact us at [email protected] for assistance.

Personal Income Tax Filing Season

Individual filing season starts 21 July 2025. Click here for more details.

South Africa | Extension of ROE Submission Deadline and Required Form

The Compensation Fund has issued a notice confirming that the 2024/2025 Return of Earnings (ROE) submission period has been extended. The ROE online system is expected to remain open until 31 July 2025, and all current Letters of Good Standing have been extended to 30 June 2025.

Employers are encouraged to submit their ROEs and supporting documents as soon as possible to avoid delays and maintain compliance.

In addition, the Compensation Fund has clarified that a Confirmation of Employer Registration Details Form must also be submitted.

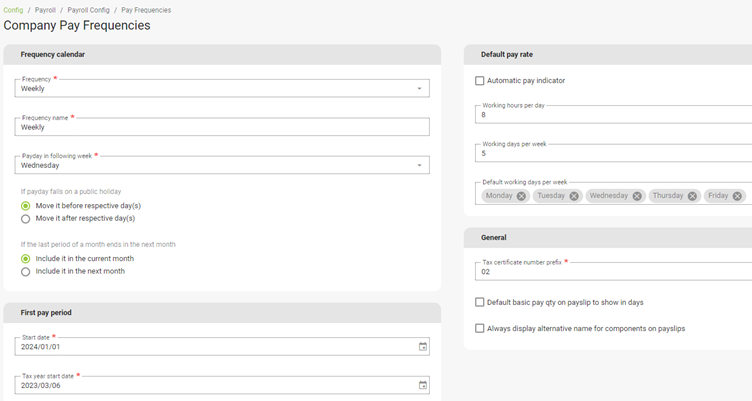

Pay Frequency Take-On Features

Streamline your implementation process by keeping payroll runs open and controlling system calculations. Here’s how these tools help:

Navigate > Config > Payroll > Payroll Config > Pay Frequencies

Keep Payroll Runs Open During Implementation

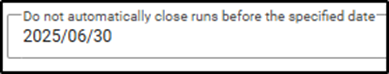

If you need to insert backdated runs instead of processing values as Year-to-Date (YTD) totals, you can keep these runs open until all payroll is processed and financials finalised and approved. Insert a date in the frequency setting Do not automatically close runs before the specified date to prevent automatic closure of backdated runs until that date has passed.

Prevent Calculations During Run-by-Run Take-On

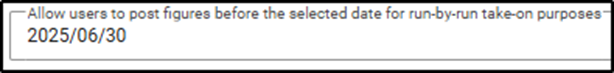

To avoid discrepancies when importing financials into employee payslips, you can suspend system calculations during run-by-run take-ons. Capture a date in the field Allow users to post figures before the selected date for Run-by-Run take-on purposes will prevent automatic calculations

Need Help? Here’s How to Contact Support

If you run into any challenges while processing payroll, our Support Team is here to assist you every step of the way. Our knowledgeable consultants are ready to help you resolve your issue quickly and effectively.

Log a Support Ticket:

Submitting a support ticket is quick and simple. To help us assist you as efficiently as possible, please include the following information:

- If your query involves a specific employee or group of employees, include their employee numbers.

- Where possible, attach a screen recording that clearly shows the issue you’re experiencing.

- The more information you provide, the quicker we can resolve your query.

Want to see how it’s done? Click here to watch a quick video on how to log a support ticket.

Call Us:

Prefer to speak to someone? Feel free to reach us by phone at +27 87 210 3000.

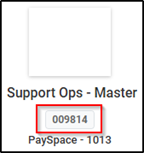

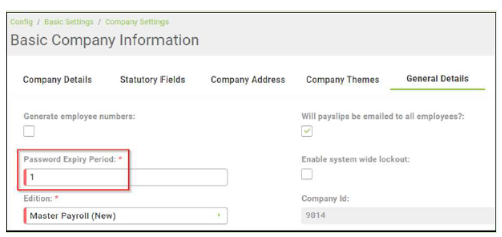

For quicker assistance, please have your Company ID and User Details ready when you call.

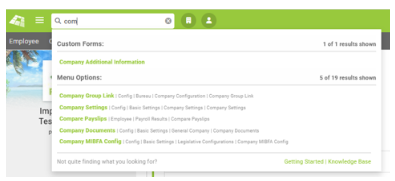

You can find your Company ID in the left-hand menu, just below the Company Name.

Did you know?

Question:

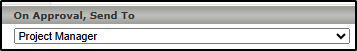

What is the purpose of the Project Manager approver option when configuring a claims workflow path?

Answer:

If you opt to use Project Costing, DLP provides a workflow option where claims related to a specific project can be approved by the Key Accounts Manager.

Contact [email protected] for more information.

PaySpace Training

We’re here to support your learning journey. Reach out to our Training Department to discover training options tailored just for you.

Click here to learn more or drop us an email at [email protected].

Upcoming Seminar

Are you ready to tackle the toughest challenges in payroll administration?

Join Rob Cooper, a leading expert in employment tax, for an insightful online seminar that unpacks the complexities of payroll compliance and prepares you for legislative changes in 2025 and beyond.

This interactive session is designed for payroll professionals who want to deepen their legislative understanding and apply it confidently in the workplace.

Important Payroll Legislation Explained Seminar Thursday, 10 July 2025

South Africa | New COIDA Gazette – Effective 25 April 2025

The Minister of Employment and Labour has published Government Gazette 52558, which provides updated guidelines on calculating annual earnings for the Return of Earnings (ROE) under the Compensation for Occupational Injuries and Diseases Act (COIDA). The Gazette is effective from 25 April 2025.

Click here for more information.

South Africa | Employment Equity Regulations Published

The Department of Employment and Labour has published final Employment Equity Regulations in the Government Gazette on 15 April 2025, marking a significant shift in workplace transformation.

Click here for more information.

South Africa | VAT Rate Remains at 15%

On 24 April 2025, the South African Minister of Finance announced the reversal of the planned VAT rate increase. The VAT rate will remain at 15%, and the proposed increase to 15.5% effective 1 May 2025 has been withdrawn.

For more details, please refer to the official media statement: National Treasury Media Statement on VAT Rate Reversal

South Africa | 2024/2025 Annual Employer Reconciliation Declaration (EMP501) Submission Dates

According to the South African Revenue Service (SARS) website, the 2024/2025 Annual Employer Reconciliation Declaration period opened on 1 April 2025 and closes on 31 May 2025.

As the closing date approaches, ensure your submission has been done.

Extended Support Hours

- Friday, 30 May 2025, 17:00 – 19:00

- Saturday, 31 May 2025, 8:00 – 12:00

Looking for help with your Annual Tax Submission? Try our DIY Guide to assist you. Click here

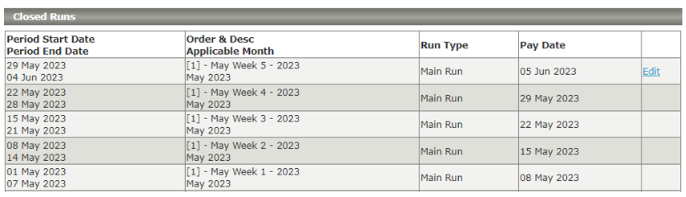

The Run Management (previously Payslip Pay Dates) screen

The Payslip Pay Dates screen has been converted to NextGen and has been renamed to Run Management.

As part of the screen conversion, we’ve introduced the following usability enhancements:

- Quick Access to Key Runs: Easily view your most recent open, closed and future runs with the option to expand future runs for more details.

- Run Status Management: Update a run’s status on the grid directly from the Status dropdown menu without needing to edit the run.

- Add Interim Runs to Closed Main Runs: You’ll now be able to add interim runs to previously closed Main Runs, not just the most recent one.

- Improved Period Visibility for Fortnightly and Weekly Runs: For Fortnightly and Weekly frequencies, we will display the specific week/fortnightly period within the processing month, for example Week 2 of 5, to help track where each run falls within the overall monthly schedule.

Important Run Management FAQs & articles to take into consideration –

Security – CAPTCHA Verification

To enhance protection against spam and automated hacks, we have upgraded our CAPTCHA verification system effective 1 May 2025.

- Customers with Whitelisted URLs

If your organisation has whitelisted specific URLs on internal firewalls, please ensure challenges.cloudflare.com is added before 1 May 2025 to avoid any access disruptions.

- All Other Customers

No action is needed. The transition will occur seamlessly.

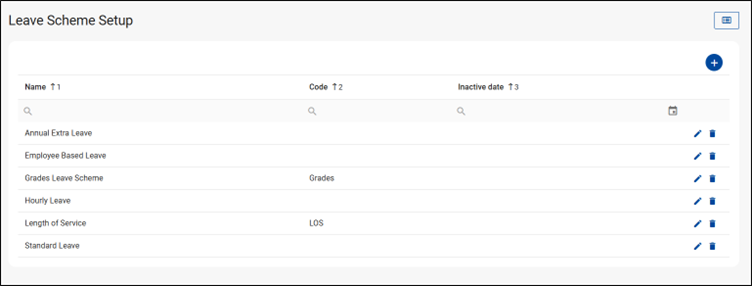

The Leave Scheme Setup screen

The Leave Scheme Setup screen has been converted to NextGen.

The grid displaying Leave Schemes supports in-row editing, allowing for convenient updates directly within the grid.

The Scheme Name column is now sorted alphabetically.

Customers on the Lite or Premier editions are limited to a maximum of three Leave Scheme configurations.

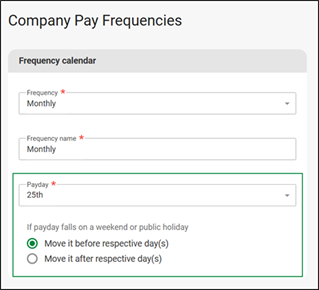

Pay Frequencies | Apply pay date changes to Future Runs

Previously, when changes were made to the pay date of an existing pay frequency, those changes only applied to runs in the next tax year.

This process has been enhanced so that when changes are made to the Payday or If payday falls on a weekend or public holiday fields, these changes are automatically applied to the existing future runs going forward.

When either of the fields is modified, users will be shown the updated run paydays on the Pay Run Preview screen.

Important

- Changes will apply only to Main Runs and will not affect Interim Runs.

- This is applicable to all frequency types.

Tune into our Podcast

We recently launched a podcast version of our monthly Newsflash to give you another way to stay updated — whether you’re commuting, multitasking, or just prefer to listen instead of reading.

Each episode is a quick, insightful roundup of the key updates, tips, and highlights that matter to you. If you haven’t already, check it out and let us know what you think.

Your feedback helps us improve — and the more followers we get, the better we can tailor content to what matters most to you.

Support Videos

Employer Annual Declaration (EMP501) Submission Period

The submission period is now open and will close on 31 May 2025. This is a reminder to ensure the following items are checked off your checklist:

- Verify that reconciliations and payments have been processed at the end of each month.

- Post interim correction runs if adjustments are needed to correct employee financials.

Navigate to Payroll Cycle > Run Management - Ensure that your company demographic and employee personal information in the system is up to date and accurate.

Employers are encouraged to familiarise themselves with the requirements and deadlines to avoid potential penalties or delays.

Access the official SARS communication and guidelines here:

SARS Employer Annual Declarations 2025

How can we help?

We’ve outlined the following options to help you manage your submission obligations and make the process as smooth as possible.

Book an Expert for Assistance

To ease the pressure of finalising your submission, you can book a consultant to guide you through the process. If this option suits you, please click here.

Do-It-Yourself

Check out our user-friendly submission guide, which provides step-by-step instructions to help you complete your Annual Submission with ease.

Quick links to FAQs

We’ve recently updated our Knowledge Base. The Annual Submission folder now contains a detailed set of FAQs, covering topics such as e@syFile errors and exporting Test and Live CSV files.

Visit the FAQs by opening your Deel Local Payroll application:

On the top right corner, click on your name > How Can We Help > at the bottom, select PaySpace Wisdom > Knowledge Base > FAQs > Annual Submission.

Below are some videos to assist with your submission process.

Visit our YouTube channel for more content.

Annual Tax Submission Workshop

The Deel Local Payroll Annual Tax Submission Workshop will guide you through the process of completing the EMP501 reconciliation and generating the CSV Tax File for submission on e@syFile™ Employer.

There are 4 workshops available:

- 10 April

- 17 April

- 22 April

- 30 April

Extended Support Hours

Please take note of our extended support hours during May:

- Friday, 30 May, until 19:00

- Saturday, 31 May, from 8:00 to 12:00

Public Holidays

Please be aware that Deel Local Payroll will be closed on these public holidays in South Africa. Although our offices will be closed on these days, our support team will be available to assist you with any questions or concerns on the following business day.

- 18 April: Good Friday

- 21 April: Family Day

- 28 April: Freedom Day (observed)

South Africa – COIDA Earnings Threshold Increase Effective 1 March 2025

The Minister of Employment and Labour has issued a Government Notice regarding the increase in the Compensation for Occupational Injuries and Diseases (COID) earnings threshold as follows:

- From R597,328 per annum (limit for 2024/2025),

- To R633,168 per annum, effective 1 March 2025 (limit for 2025/2026).

The COID earnings threshold represents the maximum annual earnings per employee on which an employer’s assessment is calculated, as per section 83(8) of the Compensation for Occupational Injuries and Diseases Act (COIDA).

South Africa | SARS PAYE BRS Changes for the 2025/2026 Tax Year:

- New Source Code for Antedated Salary/Pension:

- A new source code, 3623 (or 3673 for foreign services income), has been introduced to report antedated salary/pension amounts for previous tax years.

- Employers must obtain a tax directive to determine the correct tax deduction amount.

- Code 3907 is now limited to amounts for the 2024/2025 tax year and will no longer apply from the 2025/2026 tax year. From 2025 onwards, use 3623 for antedated salary/pension amounts.

- Antedated salary/pension amounts for the current tax year should still be reported under code 3601.

- New Codes for Section 11(nA) and 11(nB) Repayments:

- Code 4042: Used for tax deductions allowed in payroll for s11(nA) refunds.

- Code 4588: Reports the total amount repaid to an employee for an s11(nA) recoupment.

- Code 4589: Reports the total amount repaid by an employee for an s11(nB) recoupment (e.g. restraint of trade payments).

- If repayments are made outside of payroll, they must still be reported on the employee’s tax certificate to allow for correct tax calculation.

For further details, you can access the full SARS PAYE BRS Version 24.0.0 here:

SARS PAYE BRS – Version 24.0.0

ROE Online System Shutdown

- The ROE Online System will remain unavailable until 10 April 2025, with submissions for the 2024/2025 COID Return of Earnings opening on 11 April 2025.

- Unavailable services include employer registrations, ROE submissions, clearance of flagged employers for audits, and instalment applications.

- Available services include claims processing, requesting Good Standing letters, and making payments.

- The expiry date for existing Letters of Good Standing has been extended to 31 May 2025.

You can view the full notice from the Compensation Fund here: Notice of Temporary ROE Online Systems Shut-Down

Kindly note that PaySpace will be closed on the following Public Holiday:

- Friday, 21 March 2025: Human Rights Day

South Africa | 2024/2025 Annual Employer Reconciliation Declaration (EMP501) Submission Dates

According to the South African Revenue Service (SARS) website, the 2024/2025 Annual Employer Reconciliation Declaration period opens on 1 April 2025 and closes on 31 May 2025.

South Africa | New e@syFile™ Employer V8.0 effective March 2025

SARS has launched e@syFile™ Employer – Version 8.0, a new version designed to enhance the employer filing experience. Effective 1 March 2025, it will replace all previous versions.

To download e@syFile™ Employer V8.0, follow these steps:

- Log in to eFiling and select ‘e@syFile’.

- Click on ‘Download’, complete the form, and download the software.

Additional Resources

- To view the release notes, please click here.

- For detailed guidance on the new e@syFile™ Employer software, refer to the e@syFile™ Employer Guide.

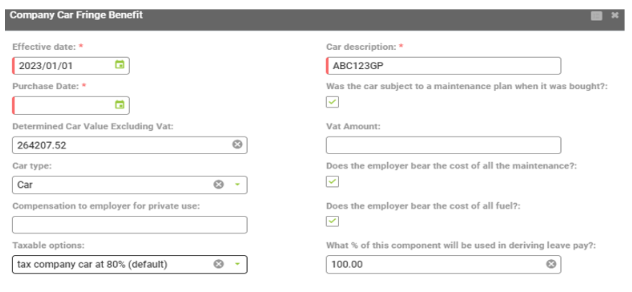

South Africa | Payroll Amendments Effective 1 March 2025

For a detailed summary of the key changes and highlights in the 2025 National Budget, please visit the following helpful resources:

Amendments based on the 2025 Budget Speech

- Changes to the ETI table effective 1 April 2025.

- VAT rate increase to 15.5%, effective 1 May 2025 (used for reporting and calculating VAT on the use of a company car)

- No changes to the tax tables or medical credits.

South Africa | 2024/2025 COID Return of Earning (ROE) Submission

For more information regarding the Compensation Fund’s 2024/2025 Return of Earnings (ROE) submission, refer to the following article: South Africa | COID Return of Earnings (ROE) Submission for 2024/2025.

South Africa | National Minimum Wage Increases Effective 1 March 2025

On 4 February 2025, the Minister of Employment and Labour published Government Gazette 52053, amending Schedules 1 and 2 of the National Minimum Wage Act (NMWA). These amendments will increase the minimum wage rates effective from 1 March 2025.

For detailed information, refer to the following article: South Africa | National Minimum Wage Increases Effective March 2025

Need help updating your minimum wage rates on PaySpace? Click here for more information.

South Africa | Increase in the BCEA Earnings Threshold Effective 1 April 2025

The Minister of Employment and Labour published Government Gazette 52232, increasing the BCEA earnings threshold from R254 371.67 per annum to R261 748.45 per annum effective 1 April 2025.

Get the full details in this article.

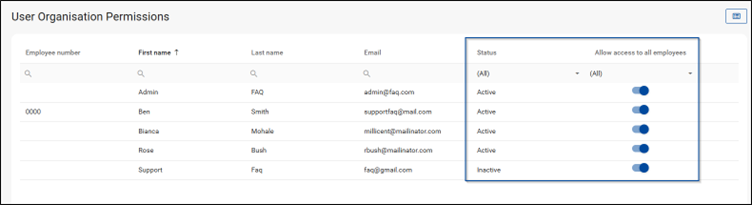

The User Organisation Unit screen

The User Org. Unit Permissions screen has been converted to NextGen and has been renamed to User Organisation Permissions.

As part of the screen conversion, we’ve introduced the following usability enhancements:

- Enhanced overview: We’ve added additional columns such as Employee number, Status and Allow Access for quick reference.

- Filtering Capabilities: Easily filter to see active users only or search for a specific user by any of the columns.

- Toggle for Access Control: A new toggle switch allows users to easily manage access for employees. Switch it on to grant access to all employees, including those without a position record (i.e. employees not linked to an Org Unit). Switch it off to allocate specific access instead using the Allocate Access Icon.

- Organised Access Allocation: The Allocate Access page is now organised into two separate tabs for Org Units and Regions permissions, respectively.

- Quick View of Selections: We’ve created a quick view section to the right of the screen of the selected Org Units or Regions to make it easy for users to see what access the selected user profile has.

Refer to the following Support video for ease of reference: User Organisation Permissions

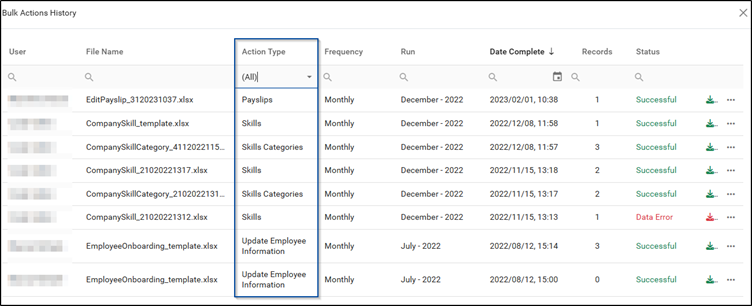

Bulk Action History – New Action Type Column

A new “Action Type” column on the Bulk Action History window has been added to help users easily identify bulk uploads processed for specific screens.

This column includes filtering capabilities, allowing users to quickly filter and view specific uploads related to each screen, even when templates are saved under different file names.

Bonus Tax Spread

For information on the configuring a Bonus Tax Spread, refer to PaySpace Wisdom.

Support Videos

Stay Informed: 2025 Budget Speech Updates

As South Africa prepares for the 2025 Budget Speech on 19 February, businesses and payroll professionals will be keeping a close eye on potential fiscal changes that could impact payroll compliance and operations.

At PaySpace by Deel, we’ll be monitoring the speech and breaking down the most important announcements—including updates on fuel and sin taxes, social grants, fiscal policies, and payroll-related amendments.

Keep an eye on your inbox and our website—we’ll be sharing a breakdown of important information.

Annual Reconciliation Declaration (EMP501) submission period

With Tax Year End nearing, PaySpace by Deel is committed to supporting you through the process of finalising your submissions. We understand the importance of accurate tax filing to avoid penalties and unnecessary fines. With our expert team by your side, you can count on a seamless and stress-free process.

Follow our monthly Support Talk Newsletter for updates on filing season deadlines. Our communications will keep you informed with all the relevant details to ensure a smoother experience during the tax year end.

South Africa | COID Return of Earnings (ROE) Submission for 2024/2025

The Department of Employment and Labour published Government Gazette No. 52069 on 7 February 2025, announcing the following key details regarding the Compensation Fund’s 2024/2025 Return of Earnings (ROE) submission:

- The submission period will run from 1 April 2025 to 30 June 2025.

- Employers must submit the ROE via the online platform.

- A 10% penalty will be applied to late submissions.

- Interest charges will apply to payments made after 30 days from the invoice date and to overdue accounts.

- Employers are responsible for ensuring timely and accurate submissions to avoid penalties and interest charges.

Frequency and Run Setups

Please check your run setups for your Monthly / Weekly and Fortnightly Frequencies. All runs created for the 2024/2025 Tax Year should have the correct Month and Year setup.

The 2025/2026 Runs should be associated with the next Tax Year.

For any discrepancies identified, please log with [email protected]

PaySpace Wisdom

We have 57 available Articles covering a wide range of topics, including e@syFile errors, exporting Reports and how to import CSV Files into e@syFile.

Visit the FAQs by opening your PaySpace application and on the top right corner, click on your name > How We Can Help > PaySpace Wisdom > Africa > Annual Submission.

Below are a few questions that may be of assistance in preparation for your filing season.

How do I reconcile the EMP501?

What are the important reports to generate for the Annual Submission?

Which report can be generated to verify employees’ non-financial information that will be included in the CSV Tax File?

Claiming for Travel

If you receive a travel allowance from your employer, you may be eligible to claim a deduction when filing your annual income tax return for using your personal vehicle for business purposes.

- Record your motor vehicle odometer reading on the 1st day of the Tax Year, i.e. 1 March and, again the closing odometer reading on the last day of February using a logbook.

- It is not necessary to record details of private travel, but a record of business travel details must be kept.

- Calculate the total kilometres for the full year.

- Calculate the total business kilometres for the year.

South Africa | National Minimum Wage Increases Effective March 2025

On 4 February 2025, the Minister of Employment and Labour published Government Gazette 52053, amending Schedules 1 and 2 of the National Minimum Wage Act (NMWA). These amendments will increase the minimum wage rates effective from 1 March 2025.

The National Minimum Wage rates will increase as follows from 1 March 2025:

- From R27.58 to R28.79 for every ordinary hour worked.

- From R27.58 to R28.79 per hour for farm workers.

- From R27.58 to R28.79 per hour for domestic workers.

- From R15.16 to R15.83 per hour for workers employed on an expanded public works programme.

- Increased weekly allowances (see table below) for workers with learnership agreements under section 17 of the Skills Development Levies Act.

Employment Tax Incentive (ETI) Criteria

- One of the qualifying criteria for the Employment Tax Incentive (ETI) is that the employee must earn at least the higher of the applicable national minimum wage rate or the minimum rate specified by the wage-regulating measure. Employers should ensure that the updated minimum wage rates, effective from 1 March 2025, are reflected in the ETI minimum wage rate configuration.

Exemption Application

- Employers who cannot afford to pay the national minimum wage can apply online for an exemption from the National Minimum Wage Act.

Additional Amendments

- The Gazette also increases the minimum wages for the Contract Cleaning Sector (Sectoral Determination 1) and the Wholesale and Retail Sector (Sectoral Determination 9) to align with the national minimum wage rates.

Need help to update your minimum wage rates on PaySpace?

Click here for more information

South Africa | Decrease in the Official Rate of Interest Effective February 2025

The official rate of interest, used to calculate the fringe benefit for low-interest or interest-free debt, is defined in section 1 of the Income Tax Act as the repurchase (repo) rate plus 100 basis points (1%). A new official rate takes effect from the first day of the month following the change in the repo rate.

On 31 January 2025, the repo rate decreased from 7.75% to 7.50%. As of February 2025, the fringe benefit for low-interest or interest-free debt must be calculated using the new official rate of interest, which will be:

- 7.50% + 1% = 8.50%.

Click here for more information.

Did you know

If an employee’s IRP5 is blank, as part of your troubleshooting, you should check the Pay Rate Screen to see if there is a Pay Rate recorded for the employee prior to the Year of Annual Submission, e.g. 2024/2025 and/or during the Period of Submission.

Welcome back to all our customers and partners. As we continue our journey through 2025, we’re excited to work alongside you in fulfilling the PaySpace mission and vision. Together, we’ll drive innovation, enhance experiences, and achieve new milestones. Thank you for your trust and support—we can’t wait to accomplish even greater things with you in the year ahead.

Medical Aid Rates – 2025

We are pleased to confirm that the 2025 Medical Aid tables have been updated. However, if you have any medical aid rates that have not been updated, please email [email protected] for assistance.

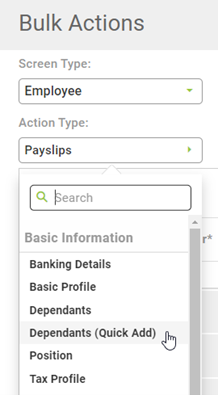

Update Employee Information

As we start the new year, we encourage our customers to ensure that their employees’ basic information is up to date. If you have access to ESS, employees can update their own profiles, provided the necessary permissions are enabled. Alternatively, employee information can be updated through Bulk Actions. For more detailed instructions, please refer to the article available in our Knowledge Base.

Annual Increases

If you require assistance with capturing annual increases, please refer to the article available in our Knowledge Base.

Enhancements and new product features

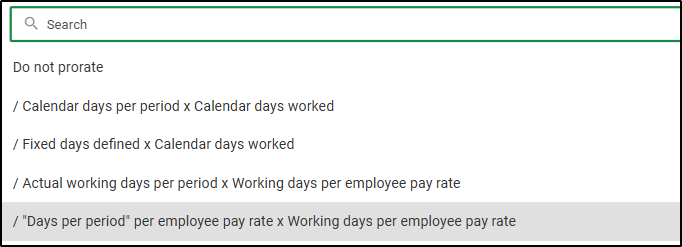

Calculation Settings – Proration Settings

Previously, the proration settings on the Calculation Settings screen were managed through a series of checkboxes, with each combination leading to a different proration method.

These checkboxes have now been replaced with a selection list that clearly represents each proration method, making it easier for users to choose and differentiate between the available proration calculation methods in the system.

New Proration settings:

Note: This update does not affect existing calculations, which will continue to function as they did previously.

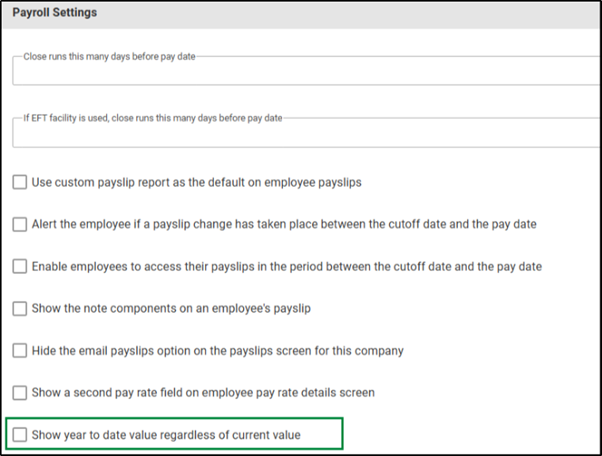

Custom Payslip – Show Year-to-Date Value Regardless of Current Value

We’ve introduced a new General Setting: “Show year-to-date value regardless of current value.” When enabled, this setting ensures that YTD values are displayed for all components on custom payslips, even if the components have no current payslip value for the period.

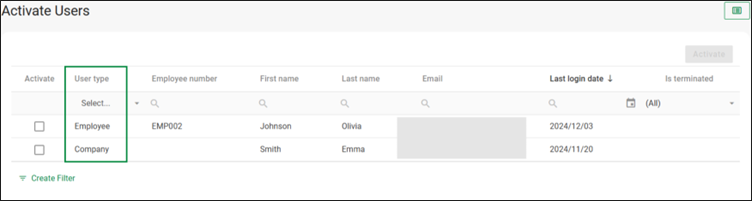

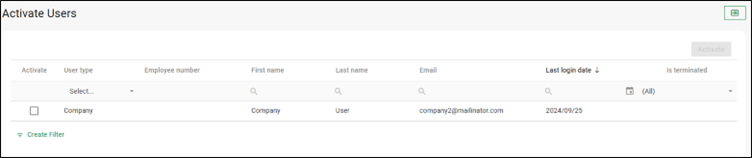

Activate Users – User type column

We have added a user type column to the Activate User screen under the Security section. Users can now determine the user type of the record before the user is made active.

Additionally, users can filter the user type column to display specific user types on the screen.

Did you know?

Question: How do I unblock a Pacey user?

Answer: A Pacey user can be unblocked on the Pacey Dashboard by clicking on the unblock option.

Navigate > Reports > Pacey Dashboard

For detailed instructions on how to unblock a Pacey user, please refer to the following link.

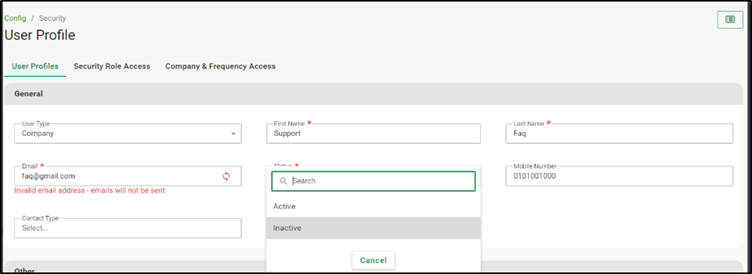

Question: How do I reactivate an inactive (blocked) user profile?

Answer: A blocked user profile can be reactivated by changing the status of the user’s profile from “Inactive” to “Active”.

Navigate > Config > Security > Security > User Profiles

Alternatively, inactive profiles can be reactivated on the Activate Users screen.

Navigate > Config > Security > Security > Activate Users

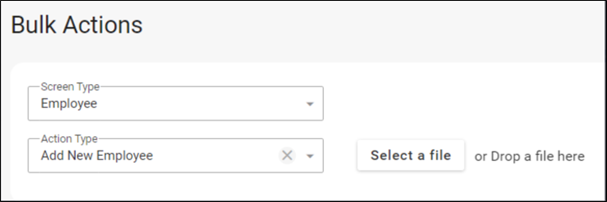

Question: Can new employees be added via the Bulk Actions screen?

Answer: To create multiple employee records, download, complete and upload the Add New Employee action type template on the Bulk Actions screen.

Navigate > Bulk Actions

Reminder: Employment Equity Amendments Effective 1 January 2025

The amendments to the Employment Equity Act (EEA) will take effect from 1 January 2025. Employers are reminded to take the following actions to ensure compliance with the key amendments:

- Review Employee Disability Status for EE Purposes

Update your records to ensure employees who qualify as disabled under the updated definition are correctly flagged for Employment Equity reporting. The revised definition now includes individuals with long-term or recurring intellectual or sensory impairments that substantially limit their prospects of employment or advancement, in interaction with various barriers. - Determine Designated Employer Status

From 2025, only employers with 50 or more employees will be considered “designated employers.” Businesses below this threshold will no longer need to comply with Chapter 3 of the EEA (affirmative action provisions).If you are no longer a designated employer, contact the Department of Employment and Labour (DoEL) to determine if, how, and when to deregister. Currently, there is no formal clarity on this process. - Prepare for Sector-Specific Numerical Targets

Designated employers must ensure their Employment Equity plans align with the forthcoming sector-specific numerical targets to be set by the Minister of Employment and Labour. While draft regulations have been published, final targets are yet to be confirmed.

- Review Employee Disability Status for EE Purposes

Importantly, we are still awaiting clarity from the DoEL regarding how employers should transition from their existing Employment Equity targets to the newly published targets once these are finalized. Employers are advised to stay informed of updates on this process to ensure a smooth transition.

Additionally, employers seeking government contracts must obtain a Certificate of Compliance, which will only be issued if they meet the sectoral targets (or provide reasonable grounds for non-compliance) and comply with reporting and minimum wage requirements.

Wishing everyone a joyful festive season.

We would like to express our gratitude to all our customers for your unwavering support throughout 2024.

May the New Year of 2025 bring you even greater success and prosperity.

Festive Season Operating Hours

Please take note of the following operating hours during the festive season:

16 December: Closed (South African Public Holiday)

- 24 December: Closing at 15:00

- 25 December: Closed (Public Holiday)

- 26 December: Closed (Public Holiday)

- 31 December: Closing at 15:00

- 1 January: Closed (Public Holiday)

Medical Aid Rates – 2025

The 2025 Medical Aid tables have been updated. Please consult Release Note #72327 for the updated premiums. If any Medical Aid is not included in the Release Note, kindly email the 2025 premium updates to [email protected].

Bonus Interim Run

Bonuses can be processed on an interim run separate from your December 2024 main run. Click here for more information.

Bonus Tax Spread (South Africa)

If you need assistance or further information about Bonus Tax Spreads, please refer to our Knowledge Base FAQs below:

Did you know?

Question: What is the purpose of the “Foreign National” checkbox on the Basic Profile screen?

Answer: In South Africa, a Foreign National refers to an individual who is not a naturalized citizen of the country where they reside.

The “Foreign National” checkbox only affects Employment Equity reports.

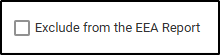

Question: How can I exclude an employee from EEA Reports?

Answer: To exclude an employee from EEA reports, select the “Exclude from the EEA Report” checkbox in the Exemptions and Other section on the Employee tab of the Basic Profile screen.

Question: On which screen can the employment status of an employee be updated?

Answer: An employee’s employment status can be updated in the Additional section of their Position screen.

Employment Equity Deadline

This is a friendly reminder that the Employment Equity Reporting for 2024 is due by Wednesday, 15 January 2025. The Employment Equity Guide can be used to complete your submission.

Employment Equity Amendment Act Effective 1 January 2025

Government Gazette 51684 has confirmed that the Employment Equity Amendment Act No. 4 of 2022 will take effect on 1 January 2025. These amendments aim to enhance equitable representation, ease administrative burdens for smaller employers, and streamline the administration of the Act. Click here for a detailed overview of the key changes.

Public Holidays 2025

As we approach 2025, we’re pleased to announce that public holidays for the upcoming year have been updated for all countries in the system. This update ensures accurate scheduling and holiday tracking for the new year.

Medical Aid Rates 2025

We’re in the process of updating the 2025 Medical Aid tables, with completion expected by 1 December 2024. The updated tables will take effect on this date.

Stay updated by checking the Release Note titled “Medical Aid Contribution Rates Update 2025” for the latest additions to the Medical Aid tables.

If you receive any 2025 Medical Aid Rates directly from providers, please reach out to us with the tables so we can ensure they are included.

Bonus Pay-outs

As we approach the end of the tax year, employees have the option to spread the tax on their guaranteed bonus across the tax year. This spread ideally takes place starting in March, allowing employees to be taxed on a monthly portion of their bonus rather than bearing the full tax amount in the month of pay-out.

With December 2024 around the corner, we encourage you to review your Bonus Tax Spread setup to ensure that payouts are processed smoothly and on time. Please note the following options and key reminders:

Bonus Tax Spread Options

- Tax Spread Until Bonus Payment – Taxes are spread only until the month the bonus is paid.

- Tax Spread Over the Tax Year – Taxes are distributed evenly across the entire tax year.

If the Tax Spread is not set up before December 2024, the entire tax amount will be recovered in December 2024, when the bonus is paid.

Provision Cancellations

If the provision is cancelled before the end of the designated period and the bonus has not been paid, any tax already collected will be refunded, and no bonus pay-out will be issued in December 2024.

Tips to Ensure a Smooth Pay-out:

- Verify Employee Recurring Setup: Check the setup in the employee’s recurring screen to confirm it aligns with expectations and ensure the pay date is set for December 2024.

- Enable Bonus Tax Spread: Confirm the checkbox for “Bonus Tax Spread” is enabled.

To ensure seamless Bonus Pay-outs, refer to the below FAQs from our Knowledge Base:

Leave Shutdown

Should you have a Company Shutdown over December 2024 / January 2025, PaySpace does cater for payments over this period.

The setup of the Leave Shutdown component requires JavaScript and customisation of the system, which is billable.

Contact our Professional Services department at [email protected] for further assistance.

Grades

The Grades screen has been converted to NextGen.

We’ve also added an API endpoint for the Grades screen which is available in our API documentation.

The Additional Value descriptions have been moved to a separate tab that is displayed at the top of the screen with the ability to reorder descriptions using drag and drop motion.

Creating Grades via Bulk Actions

As part of this conversion, we’ve also created a Grades bulk upload that allows users the ability to maintain multiple company Grade details with a single upload.

The Grades bulk upload is accessible under the company “Organization Structure” section.

The template includes the following Grade screen fields, along with additional value description fields configured per company:

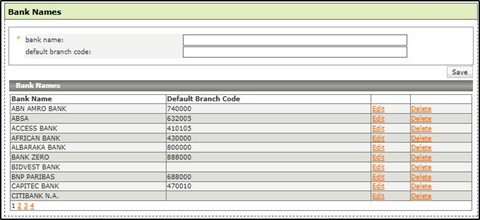

Other Dropdowns – Bank Names

A new Bank Names section is available on the Other Dropdown menu that allows users the flexibility to add and maintain bank information shown on the Bank Name dropdown list on the employee’s Banking Details screen.

The same standard list previously available on the Banking Details screen has also been incorporated into the Other Dropdown menu for users to maintain bank name details as needed.

Previously, if a bank name was missing from the dropdown, it had to be added manually through the Bulk Actions screen for each employee. With this update, bank names only need to be added once in the new Bank Names section. From there, the bank will appear on the dropdown list for all employees—no additional manual entries needed.

Please note:

- Previously manually added banks have not been removed from any employee records.

- For employees with accounts at banks that were previously unavailable on the dropdown list, you’ll need to re-add these banks in the Bank Names section for consistency and future access on employee level.

This enhancement streamlines bank data management, making it easier to ensure employee records are accurate and up to date.

Please note: This feature is only available on the Premier and Master editions.

User Profiles & Activate User – Employee Number Column

A new Employee Number column has been added to both the User Profiles and Activate User screens, making it easier to search for and locate employee user profiles.

User Profiles screen

Activate Users screen

Did you know?

- You can configure Special or company -specific leave/holidays using the Public Holidays screen. Refer to the following article for more information: Leave | The Public Holidays screen.

- If an ESS or Admin profile is reactivated, it is essential that the user logs into the system and performs an activity to keep the account active. When there is no login activity on the account within one week of reactivation, the profile will be automatically deactivated.

To avoid repeated reactivations, please remind users to log in and engage with the system promptly after reactivation.

Year End Function: Early Closure of Support Desk

Please note that all Support Desks will close at 14:00 on Friday, 22 November.

South Africa: PAYE Employer Interim Reconciliation

With the Bi-Annual Tax Filing season 2024/25 deadline approaching, we encourage you to finalise your submission before 31 October 2024.

A reminder on our Extended Support Hours

We have extended our support hours to assist you with finalising your submission. Our support consultants will be available for extended support on the following days:

Saturday 26 October 08h00 to 12h00

Thursday 31 October till 19h00

Preparation reminders for your Bi-Annual Submission

- Update your e@syFile with the latest e@syFile software update.

Be reminded that when logging into e@syFile, check that you have done a backup before installing the latest available version. At time of publication the latest version of e@syFile is Version 7.4.4. - For a comprehensive Bi-Annual Submission checklist / Do It Yourself Guide, please download the Bi-Annual Submission DIY Tax Filing Guide. This guide provides detailed instructions on finalising your payroll, uploading your files, and successfully completing your submission.

- If you are preparing for your first submission, let us assist you with a one-on-one consultation.

- If you require Payroll Tax Submission Training, please complete the Booking Form. We have 2 sessions scheduled this month.

– 17 October 2024

– 24 October 2024

- Update your e@syFile with the latest e@syFile software update.

Important Reminder

If you identify any errors in your financial records for the current tax year, an August 2024 interim run can be inserted to rectify any errors.

Complete the Run Management Template and log a request with [email protected].

Download the Run Management Template here.

Net Promoter Score (NPS)

Net Promoter Score (NPS) is a vital tool we use to measure your satisfaction and loyalty. It operates on a scale from – 1 to 10, and your responses fall into three categories:

Promoters (Score 9-10): Customers who rate us as promoters are highly satisfied and enthusiastic about our products or services. They will likely recommend us to others and play a crucial role in spreading positive word-of-mouth.

Passives (Score 7-8): Passives are satisfied with our offerings but less likely to actively promote our brand. While they may continue doing business with us, they might also be open to considering alternatives.

Detractors (Score 0-6): Detractors express dissatisfaction with our products or services. They are unlikely to recommend us and may share their negative experiences with others, potentially impacting our reputation.

Your opinions matter to us, and we genuinely appreciate your participation in our NPS surveys.

Your feedback fuels our drive to deliver the best possible service. It ensures that we remain focused on meeting your needs and providing unparalleled satisfaction.

Cloud Room

Cloud Room is a secure portal within PaySpace geared towards outsource environments and payroll processes where customers send information to PaySpace and vice versa for processing and feedback/response purposes. Instead of exchanging information via insecure methods such as email, Cloud Room provides a secure portal to upload as well as track item statuses.

Please use our Knowledge Base of Articles and FAQ’s for more information on our Cloud Room feature.

- How do I setup Group Names for Cloud Room items?

- How do I setup Checklist Items for Cloud Room?

- How do I create a child Cloud Room item?

- Does the system verify whether an Attachment selected has been successfully uploaded to Cloud Room?

- Will the new assigned user receive an email notification once a Cloud Room item is assigned to them?

Security Role Screen Enhancement

With the Security Role Screen conversion to NextGen. Listed below are some Enhancements that may benefit your navigation of the screen.

- Create a new Security Role by clicking the ‘+’ icon, which generates a new row for the Security Role.

- See an overview of the total number of users associated with each Security Role.

- An ESS role will now be available by default for both new and existing companies that did not have an ESS role setup previously. The same default ESS permissions applied to the ESS security role in the backend will now be available for companies to update permissions as needed.

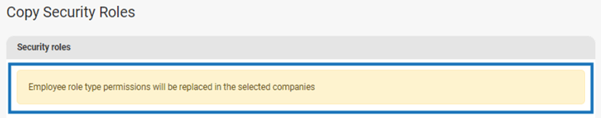

- The ‘copy roles’ functionality now allows you to copy multiple Security Roles to multiple companies.

The menu branch will only display menu items relevant to the Security Role type. For example, a role designated as ‘employee’ will only show employee-related menu items. - The menu branch has been reorganised to display the order of menus as seen on screens where the description of menus and their fields are consistent with those on screen making it easier to search or locate menus and field names.

Release Notes

For the latest updates on Releases to Production, refer to our Release Notes on the system.

These notes provide detailed information on each release, including the country, development task number, and release date.

You can review all relevant details about the tasks, release specifics, and any impact on your company and where applicable, the Country.

The content covers recent changes, feature enhancements, and legislative changes.

Did you know?

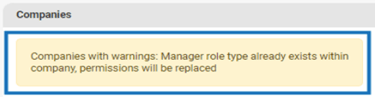

Question

When copying security roles, such as the ESS role, will it replace the existing roles in the target company, or will it be added alongside them?

Answer

The ESS and MSS security roles will override as you can only have 1 of each. However, Admin roles will create a duplicate, appended with “copy – 1”. Moreover, if you try to copy ESS or MSS Security roles an alert will be shown on screen.

ESS:

MSS:

Question

Can a user use the same email address to access Cloud Room in companies that are not within the same group?

Answer

No, the user will be required to use separate email addresses per company.

The Two-Pot Retirement System

The Two-pot calculator and Personal Income Tax registration are now accessible via the SARS USSD channel. These features have already been introduced on other platforms, including WhatsApp, MobiApp, and the SARS Online Query System (SOQS).

Click here for more information.

2024 Employment Equity Reporting

We have Employment Equity workshops scheduled over the next few months.

- We will explore the information that should display in the EEA2 and EEA4 reports and address the relevant fields that need to be completed on the payroll.

- Additional reports that break down the detail of information included in the statutory reports are explained.

Join us for this interactive session to consider scenarios such as transferring or reinstating an employee and the impact it will have on the statutory reports.

Please use our Knowledge Base of Articles and FAQ’s for more information on Employment Equity.

- How do I setup an Employment Equity Plan?

- How do I compare the EEA Report Targets vs the Actual results?

- How do I correct the system if the “terminated for statutory reporting” checkbox was not enabled during the employee transfer process so that the EEA reports are correct?

- How do I exclude an employee from the EEA Reports?

- Which pages of the EEA2 report does the system automatically populate and which pages require to be completed manually?

Below are a few videos for ease of reference:

- How do I setup an Employment Equity Plan

- How do I compare the EEA Report Targets vs the Actual results?

- How do I correct the system if the “terminated for statutory reporting” checkbox was not enabled during the employee transfer process so that the EEA reports are correct?

- How do I exclude an employee from the EEA Reports?

- Which pages of the EEA2 report does the system automatically populate?

South Africa: PAYE Employer Interim Reconciliation

As the Bi-Annual Tax Filing Season for 2024/25 commences, we suggest you review your payrolls and prepare for submission.

Below are a few steps to assist in preparation for your submission process:

- Update your e@syFile with the latest e@syFile software update.

Be reminded that when logging into e@syFile, check that you have done a backup before installing the latest available version. - The 2024/25 PAYE Employer Interim Reconciliation (EMP501) submission period is from 16 September 2024 to 31 October 2024.

- For a comprehensive Bi-Annual Submission checklist / Do It Yourself Guide, please download the Bi-Annual Submission DIY Tax Filing Guide. This guide provides detailed instructions on finalising your payroll, uploading your files, and successfully completing your submission.

- We have extended our support hours to assist you with finalising your submission. Our support consultants will be available on:

Saturday 26 October 08h00 to 12h00

Thursday 31 October till 19h00

New Tax File Breakdown Report

A new financial report has been added to the Tax Certificate Run screen.

Navigate > Reports > Tax Certificate Run.

This report provides the following details to assist with the tax submission process:

- This report will return all the financial details per employee, according to the tax file.

- Each tax code (source code) with financial values will be returned in separate columns.

- All Income, Deduction, Total, and Tax source codes will be returned.

- The report can be used to reconcile the tax file.

Use our available resources:

Our Knowledge Base:

An updated collection of knowledge articles is available to assist with your submission process that is accessible at your convenience. To view, open PaySpace; on the top right corner, click on your name > How Can We Help > at the bottom, select PaySpace Wisdom > Knowledge Base > FAQs > Bi-Annual Submission.

Videos:

We have published 10 videos on YouTube to assist with your Bi-Annual Submission process.

Below are a few videos for ease of reference:

– Reconciling the EMP501

– Processing corrections

– Generate and validate the Live CSV File on e@syFile

- Book now for the Mid-Year Tax Submission Workshops to assist with your training needs on the Bi-Annual Submission process.

- If you are preparing for your first submission, let us assist you with a one-on-one consultation.

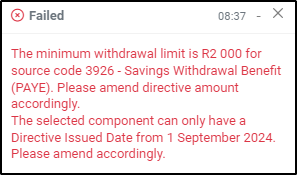

The Lump Sum Directive screen enhancements

- If an incorrect Directive Number (with alpha-numerical characters) is entered for any of the following source codes—3901, 3915, 3920, 3921, 3922, 3923, 3924, and 3926—a validation error will be shown.

- The maximum number of tax directives that can be entered on the Lump Sum Directive screen has been revised to 4 directives per tax record for the following tax statuses:

- Directive

- Independent Contractor (Directive)

- Non-Resident NED (Tax Directive)

- An on-screen error message will be displayed if source code 3926 is entered with a date before 1 September 2024, a directive amount less than R2,000, or if multiple instances of source code 3926 are recorded on the same tax record.

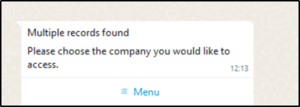

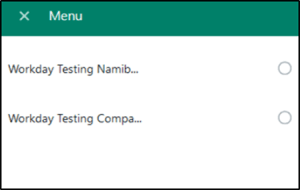

Pacey: Ability to access multiple records

We have introduced a feature that enables users to access their profiles across various companies using the same cell phone number. If multiple active profiles are found after successful authentication, employees will need to select the profile they want to log in with on Pacey.

The user will receive a message indicating that multiple records have been found.

The user will then need to choose the profile they wish to log in with, as indicated.

Please note:

Only active employee profiles from companies with an active Pacey module will be returned.

Did you know?

Q: Can I generate a consolidated tax file for a company with multiple frequencies?

A: Once the below company setting is enabled, the generated tax file will be a consolidated tax file located on the frequency in which it was created.

Navigate > Configuration > Basic Settings > Company Settings > Company Settings > General Settings > Statutory Settings.

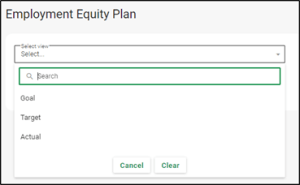

Q: Where can I setup my Employee Equity Plan?

A: Navigate > Configuration > Human Resources > Employment Equity > Employment Equity Plan.

Users will be able to set up their Goals, Targets and Actual Results.

Q: How does a conversation on Pacey work?

A: All conversations on Pacey are measured in 24-hour increments, or “sessions”, that start whenever the user sends the first “Hi” message to Pacey.

2024 Employment Equity Reporting: Key Information for Designated Employers

All designated employers are required to submit their 2024 Employment Equity (EE) reports (EEA2 and EEA4 forms) within the prescribed deadlines.

Who is a designated Employer?

According to the Employment Equity Act, a “designated employer” refers to:

- Employers with 50 or more employees;

- Employers with fewer than 50 employees but whose total annual turnover meets or exceeds the thresholds listed in Schedule 4 of the Act, equivalent to that of a small business;

- Municipalities, as outlined in Chapter 7 of the Constitution;

- Organs of state, as defined in section 239 of the Constitution, excluding the National Defence Force, the National Intelligence Agency, and the South African Secret Service;

- Employers bound by collective agreements under sections 23 or 31 of the Labour Relations Act, which appoint them as designated employers to the extent outlined in the agreement;

- Employers who voluntarily choose to become designated.

Reporting Deadlines

For electronic submissions, the reporting period is from 1 September 2024 to 15 January 2025 and must be submitted via the online system. For manual or non-electronic submissions, reports must be submitted by 1 October 2024.

Employers who are newly designated between April 2024 and October 2024 will submit their first report by 15 January 2026 for online submissions or by 1 October 2025 for manual submissions.

Compliance and Penalties

Non-compliance with EE reporting requirements may result in penalties, which vary depending on the severity and frequency of the offence. To avoid penalties, employers are encouraged to submit their reports on time and stay informed about their responsibilities as designated employers.

For more details and to access the online reporting system, visit the Department of Employment and Labour’s website: www.labour.gov.za.

Two-Pot Retirement System SARS Update

SARS has introduced a new webpage that taxpayers are encouraged to visit before applying for two-pot savings withdrawals from their retirement funds. The page also provides additional information about the two-pot retirement system for those seeking further details.

Two-Pot Retirement System | South African Revenue Service (sars.gov.za)

Legislative News

The 2024/2025 Bi-Annual Submission

South Africa – 2024/2025 Employer Interim EMP501 Reconciliation Filing Season

The Interim EMP501 Reconciliation filing season will commence on 16 September 2024 and end on 31 October 2024. SARS will release a new version of the e@syFile™ software to incorporate the updates introduced in the new PAYE BRS V23.0.0, effective from the 2024/2025 tax year.

The Two-Pot Retirement System

Effective 1 September 2024:

Contributions towards retirement funds (pension fund, provident fund and retirement annuity fund) will be split into two:

- 1/3rd to the savings pot, and

- 2/3rd to the retirement pot.

Employees will be allowed to make an annual (once per tax year) withdrawal from their savings pot at their retirement fund (with a minimum limit of R2,000, no maximum limit but subject to available funds).

Who is the ‘Employer’ when it comes to the Two-Pot Retirement System?

Effective 1 September 2024:

- Contributions towards retirement funds (pension fund, provident fund and retirement annuity fund) will be split into two:

- 1/3rd to the savings pot, and

- 2/3rd to the retirement pot.

- Employees will be allowed to make an annual (once per tax year) withdrawal from their savings pot at their retirement fund (with a minimum limit of R2,000, no maximum limit but subject to available funds).

- For more information on the Two-Pot Retirement System, refer to the Research Info post dated 13/06/2024.

Who pays the savings withdrawal to the employee?

The fund or fund administrator will be responsible for paying the savings withdrawal benefit to the employee.

Who is responsible for applying for a tax directive?

The fund or fund administrator must apply for a tax directive at SARS to calculate the PAYE before making payment.

Why does it refer to “employer” if it is the fund and not the ‘active’ employer who is responsible for the directive and payment?

An employer is defined as any person who pays or is liable to pay any amount by way of remuneration. From 1 September 2024, the savings withdrawal benefit will be included in remuneration. Therefore, since the fund or the fund administrator is paying remuneration by means of the savings withdrawal benefit to the individual, they are deemed an employer for PAYE purposes, irrespective of the fact that the individual is not actively working for the fund.

Will I get a tax certificate from the fund?

Yes, the fund (which is the deemed employer) will process the savings withdrawal benefit on their payroll software according to the tax directive information. The lump sum will be reported against SARS source code 3926 and the tax according to the tax directive against SARS source code 4102. The fund will pay the PAYE value when they submit their EMP201 for the month. The fund will also submit Interim and Annual EMP501 Reconciliation submissions and you will receive a tax certificate (IRP5(a) or IT3(a)).

Will I have 2 tax certificates if I also work for another employer?

Yes, at the end of the tax year, you will have two tax certificates, one from the fund or fund administrator who paid the savings withdrawal benefit and one from your employer who paid your salary.

Is it possible that I have a tax shortfall on assessment due to the savings withdrawal benefit?

Yes, it is possible. The savings withdrawal benefit is included in taxable income and subject to the normal personal income tax progressive tax tables. When the fund applies for a tax directive, SARS will calculate the PAYE based on the available data, which will only be an estimate. The final tax liability will only be calculated upon assessment. This could result in a PAYE shortfall or surplus, depending on numerous factors.

System Enhancements & New Features Released

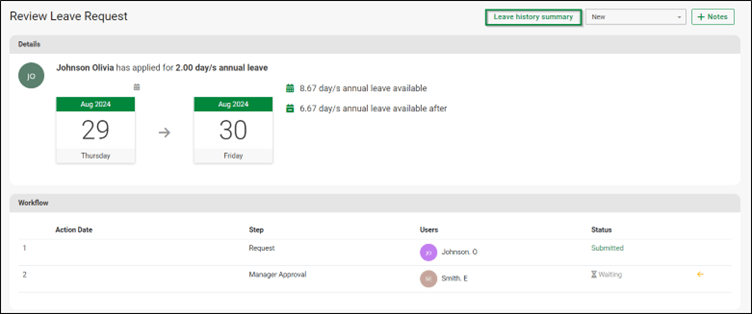

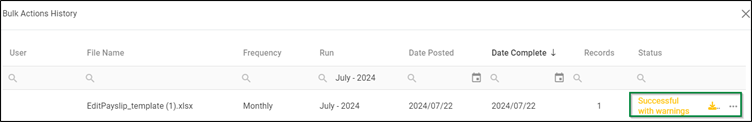

Leave Approval – Leave History Summary

The Leave Approval screen has a new feature which gives an employee’s Directly reports to person the ability to review their leave history prior to processing their leave application.

When an employee submits leave, the Directly reports to person will have the option to view the employee’s leave history by clicking on the ”Leave history summary“ button.

A summary of the employee’s leave history over the past year will be reflected as seen below.

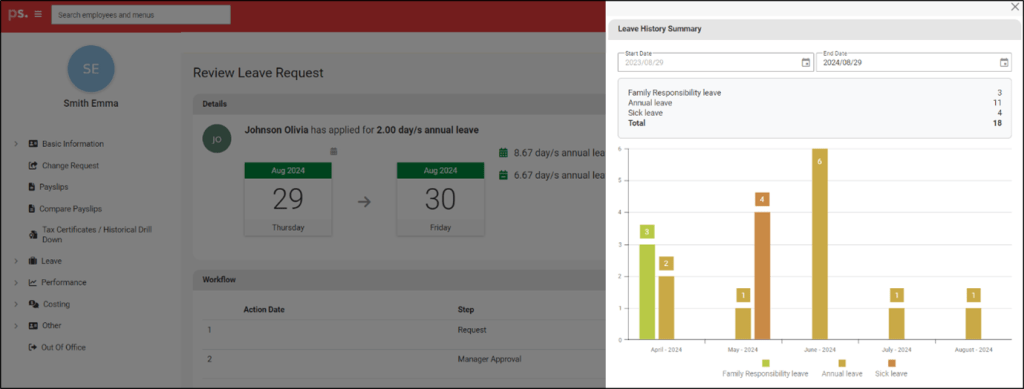

Bulk Actions – Terminated employee validation warning

We have enhanced the Payslip action type on the Bulk Actions screen to warn users when payslip figures for terminated employees are uploaded. This is to help prevent users from posting values to terminated employees in error.

The bulk upload processed with terminated employee records will be reflected in a different colour and the status of the upload will read: “Successful with warnings”.

The template downloaded from the bulk action history will reflect the warning: “Values imported on terminated employee record” on rows with terminated employees.

Important! The new validation warning serves as a warning message and is displayed on the template after posting figures for terminated employees.

Did You Know?

Q: When a manager logs into their ESS profile, why are some subordinates who do not report to them being displayed?

A: When troubleshooting, check the employee’s position screen to verify if the “Directly Reports to Position” field has been updated. If it has been updated incorrectly, the employee may appear on a manager’s dashboard even though they do not report to that manager.

The user can delete the information captured in this field to correct the issue.

Q: When transferring an employee from one company to another within my group of companies, how can I prevent the employee number from changing?

A: To resolve this, enable the “Keep existing employee numbers on transfer” checkbox.

Navigate > Configuration > Basic Settings > Company Settings > Basic Company Information > General

DIY: Some helpful videos

Filing Season for Individuals

The South African Revenue Service (SARS) announces 15th July 2024 as the start of the Filing Season for provisional and non-provisional taxpayers who are required to file a tax return. The deadline is set to 21 October 2024 for Individual taxpayers (non-provisional).

Auto-assessments for an expanded pool of taxpayers will run from the 1st to the 14th July 2024. Click here for more information.

SARS launched a self-service WhatsApp channel

Taxpayers can now use WhatsApp to interact with SARS for tax advice and specific personal income tax queries.

Click here to read more about the services available.

UIF uFiling Bulk Upload File

The Department of Employment and Labour (DoEL) has implemented changes regarding the Unemployment Insurance Fund (UIF) declarations for foreign employees. These changes are designed to improve the accuracy and efficiency of UIF submissions and UIF claims.

Background of the Changes:

Since the inception of the UIF system, there have been two Acts governing UIF contributions: the Unemployment Insurance Contributions Act, administered by SARS, and the Unemployment Insurance Act, administered by the Department of Employment and Labour (DoEL). Employers registered with SARS pay UIF contributions to SARS via the EMP201 and submit a UIF declaration to the DoEL before the 7th of the following month. Employers not registered with SARS pay UIF contributions directly to the DoEL and also submit the UIF declaration to the DoEL before the 7th of the following month.

In 2003, the DoEL introduced electronic submissions by allowing employers to send an electronic UIF declaration file to the Fund. For employers without access to appropriate software, manual submissions were required. Around 2012/2013, the DoEL launched the uFiling system to eliminate manual submissions and facilitate online UIF claims.

The internal UIF system, Siyaya, was designed to manage UIF data. However, it did not account for foreign employees, as they were initially exempt from contributing to UIF and due to ever-changing passport numbers. In March 2018, legislation changed to require foreign employees to contribute to UIF, but Siyaya was never updated to accommodate this change. Consequently, foreign employees’ claims are handled manually, requiring a UI19 and Salary Schedule.

Recently, the DoEL made enhancements to uFiling to address these issues and improve the overall process. These changes include:

- Removing the limitation on the number of employees in the bulk upload file.

- Introducing a new dashboard to confirm file import success, display the number of employees, and provide error/warning files for correction before submitting the declaration.

To ensure accurate processing, the DoEL now mandates that foreign employees be declared via the uFiling portal, while local employees can continue to be declared via the UIF declaration email file or uFiling. If using uFiling for both local and foreign employees, employers must submit two separate files (one for local employees and one for foreign employees) to prevent processing delays due to the inability to integrate foreign employee data into Siyaya.

Key Updates:

- uFiling System Enhancements:

- The limitation on the number of employees in the bulk upload file has been removed.

- A new dashboard has been created to confirm successful file imports and provide error/warning files for correction before final submission.

- Submission Process for Foreign Employees:

- Foreign employees must now be declared via the uFiling portal, as the Siyaya system does not accommodate foreign nationals.

- While uFiling will store information for foreign employees, it will not update the Siyaya database. Employers must still submit a UI19 and Salary Schedule when a foreign national claims UIF benefits.

- Submission Process for Local Employees:

- The preferred method for declaring local employees remains sending the electronic UIF declaration file to the Fund. Employers must confirm they received the automatic reply email indicating the file was successfully processed.

- Employers can choose to use uFiling for local employees; however, two separate files (one for local employees and one for foreign employees) should be submitted (if applicable) to avoid processing delays.

- Employers should not use a combination of uFiling and the electronic UIF submission file to declare local employees, it should be either one or the other.

- Synchronization Issues:

- Be aware of potential syncing issues between Siyaya and uFiling. Historical declarations may not display correctly on uFiling, but this does not indicate that previous submissions via the UIF electronic declaration file were unsuccessful.

More information will be provided in the Preliminary Release Notes in due course.

Enhancements and New Features released

Business Partners ability to register for ESS

Business Partners can now register for ESS using the same email address linked to their BP Profile. This feature allows BPs to switch between ESS and Admin view using one email address.

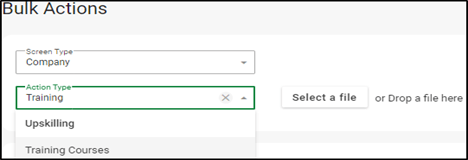

Bulk Upload Training Courses

Customers can now upload Training Course descriptions in bulk. The new action type drop-down option is displayed under the company “Upskilling” section.

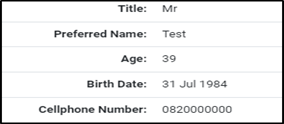

Employee details – Cellphone number

Employee cellphone numbers taken from the Employee’s Basic Profile > Contact tab has been added to the pop-up screen visible after a user clicks on an Employee’s Name.

Our Knowledge Base

We are updating our Articles and Frequently Asked Questions library. Please consult this resource for answers to any questions you might have while using the system.

PaySpace Training

Unlock the full potential of PaySpace software with our streamlined payroll and compliance training. Click here for more information or email [email protected].

Practical Payroll Solutions Virtual Seminar

This virtual seminar is the most comprehensive and practical of its kind leaving you with a vastly improved understanding of the important areas of practical payroll administration policy and their tax implications.

Did you know.

Question

How do I upload a photo to an employee’s profile?

Answer

An employee’s photo can be uploaded under the Personal tab on the Basic Profile screen.

Navigate > Employee > Basic Information > Basic Profile > Personal tab > Employee photo

Question

How do I configure the system so that employees can download their IRP5s on ESS?

Answer

For employees to download their IRP5s on ESS, access to the Tax Certificates / Historical Drill Down screen must be granted on the ESS security role.

Navigate > Configuration > Security > Security > Security Roles

Question

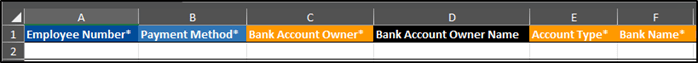

How do I add a bank if it does not exist on the employee’s Banking Details screen?

Answer

If a bank does not exist on the employee’s Banking Details screen, it can be added via the Bulk Actions screen. Add the employee’s bank details (the new bank name in column F) on the Bulk Actions spreadsheet.

Videos

Below are a few videos that might be helpful:

Annual Reconciliation Declaration (EMP501)

Congratulations on successfully completing your Annual Reconciliation Declaration Submission.

If you have not completed your submission, we are happy to assist you.

Kindly please reach out to us at [email protected].

Personal Income Tax Filing Season

Individual filing season starts on 15 July 2024. Click here for more information.

OID Return of Earnings

The Director General of Employment and Labour published Government Gazette 50386 on 27 March 2024, confirming the 2023/2024 OID Return of Earnings submission period runs from 1 April 2024 until 30 June 2024. Please click here to view the government gazette.

Related FAQs:

Where can I download the COIDA Return Report?

Where can I download the COIDA Breakdown Report?

How is the COIDA Income note component calculated?

Knowledge Base

Our Knowledge Base contains an extensive collection of articles and frequently asked questions. Feel free to utilise our information library to support your payroll processing needs. We consistently update our resources to improve your experience with the PaySpace System.

In the top right corner, click on your name > How We Can Help at the bottom, select PaySpace Wisdom > Knowledge Base > Articles / FAQs.

We’d be grateful if you could give our Articles / FAQs a thumbs up or down for us to determine if our Articles/FAQs are helpful.

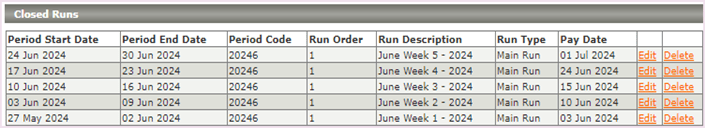

Payroll Cycle changes

When there is a need to make changes to Run Descriptions and Period Codes, reviewing your run setup on the system is important.

Changes cannot be made to runs in closed status.

Example below:

Change June Week 5 – 2024 to July Week 1 – 2024

- All runs associated with June 2024 will need to be reopened.

- With changing June Week 5 – 2024 to July Week 1 – 2024, a month-to-date recalculation is required on all weeks associated with June 2024.

- If your monthly declarations have been finalised, specific to this example, that would be June 2024, financial reports will have to be exported before opening the June 2024 runs and saved, and financial reports will have to be exported after closing the June 2024 recalculated runs.

- Both reports exported before and after closing June 2024 runs will have to be reconciled, and if there are any undesired changes to employee financials, corrections will need to be processed on an interim run.

Related FAQs:

Can a frequency be deleted once it has been created?

Did you know?

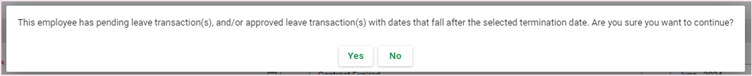

The Tax Profile screen has been enhanced to notify users in the form of an on-screen pop-up when an employee has any pending or approved leave transaction with dates that fall on or after the selected termination date.

Two -Pot Retirement System

The Revenue Laws Amendment Act, 2024, has been promulgated via Government Gazette 50750, with an effective date of 1 September 2024.

The Act establishes the Two-Pot Retirement System, effective 1 September 2024. This new system aims to promote the preservation of retirement fund investments until members retire while allowing access to a portion of accumulated savings during their working years.

Below is a brief summary of how this will influence payroll:

- Effective 1 September 2024: All contributions to provident, pension, and retirement annuity funds will be split into two components: one-third will be credited to a savings component, and the remaining two-thirds to a retirement component. The retirement component will be inaccessible before retirement and must be used to purchase a pension-providing product at retirement. This will be administered by the Funds.

- Vested Component: Contributions made before 1 September (vested rights as of 31 August 2024) will go into a vested component, with current rules (including those on accessibility and tax) continuing to apply.

- Seeded Capital: As of 1 September 2024, 10% of the vested retirement funds (retirement fund account as of 31 August 2024), limited to R30,000.00, will be allocated to the savings component.

- Pre-Retirement Withdrawals: Employees will be allowed to withdraw from the savings component before retirement without terminating employment. The minimum withdrawal limit is R2,000, with no maximum limit, subject to available funds in the savings component. Withdrawals can be made once per tax year (1 March – 28/29 February) from 1 September 2024.

- Tax on Withdrawals: Savings withdrawals will be included in PAYE remuneration, and the employer (retirement fund or administrator) must apply for a tax directive to determine the amount of PAYE to withhold before payment to the employee.

- New Source Code: SARS has created source code 3926 for reporting savings withdrawals. The tax per the directive will be reported against source code 4102.

- Taxation: Savings withdrawals will be taxed according to the normal Personal Income Tax (PIT) progressive tax tables and included in normal taxable income, rather than the special retirement fund withdrawal benefit progressive tax tables.

Please note: If an employee is a member of a provident fund and was 55 or older on 1 March 2021, they will be excluded from the two-pot system unless they choose to participate.

PaySpace will implement the necessary adjustments to accommodate savings withdrawals effective 1 September 2024.

Click here to read more on the Two-Pot Retirement System, or contact your Fund or administrator for more information.

Employer Annual Declaration (EMP501) submission period

With just over two weeks left before the submission period deadline of 31 May, here is a reminder of the options available:

- Request a PaySpace consultant to submit on your behalf

- Submit the annual declaration yourself by using our various tools to assist you:

- The explanatory submission guide

- Helpful FAQs from our Knowledge Base

If your test file fails upon importing to e@syFile, we have created FAQs explaining how to resolve specific errors:

- How do I correct e@syFile™ error: “Code 4474 is mandatory if an amount is specified for code 3810/3860 and Nature of Person (3020) is A, B, C, M, N or R”

- How do I correct e@syFile™ error: “Employee SIC7 Code (3263) is invalid”?

- How do I correct e@syFile™ error: “The value of code (3833/3883) /” must be equal to the value of code 4584″

If you prefer videos, have a look at the below clips

- Important Reports to Print for the Annual Submission

- Determining Variances on Employee Records

- Validating the Test CSV File on e@syFile.

Extended Support Hours

To ensure all our customers meet the submission deadline, our friendly support consultants will be available to assist on the dates below:

- Saturday, 25 May, from 08:00 to 12:00

- Friday, 31 May, until 19:00

South Africa National Election Day

29 May 2024

PaySpace will be closed on Wednesday, 29 May 2024 due to National Election Day, in South Africa. Our offices will be closed, but our support team will be available to assist you with any queries or concerns you may have the following business days.

COIDA

Employers are to take note of the extended deadline set for 30 June 2024 to submit the Compensation for Occupational Injuries and Diseases Act (COIDA) Return of Earnings (ROE). The extension for the period covering 1 March 2023 to 29 February 2024 was announced in a Government Notice.

Our PaySpace Knowledge Base includes several FAQ’s on COIDA.

Did you know?

The security permissions on the EMP501 Report have been enhanced.

Report Name: EMP501 Report

Report Description: Provides the EMP501 for the selected tax year. The report can either be run for a bi-annual period or the full tax year.

Report Changes:

- If a user has restricted access to certain organisation units or regions, then the user will not be able to generate the report, and the below message will return:

“You are linked to organisation units or regions and therefore do not have permission to execute this report.”

- If the security role is set to read-only then the user will be able to view the report on the report menu but will not be able to generate the report.

- If the security role is set to deny then the user will not be able to generate the report and will receive a “Security Access Denied” error.

Employer Annual Declaration (EMP501) submission period

The submission period has commenced and closes on 31 May 2024.

This is a reminder to have the items below ticked on your checklist.

- Verify that your reconciliations and payments have been processed at the end of every month.

- Post interim correction runs if any adjustments are needed to correct your employee financials.

Navigate to Payroll Cycle > Payslip Pay Dates - Confirm that your company demographic information and employee personal information on the system are accurate.

How can we help?

We have compiled two specific options to help you through your submission obligations and make the process seamless.

Book an expert to assist

To minimise the pressure of finalising your submission, you can always book a consultant to assist you with the submission process. If this option best suits your needs, please click here.

Do-it-yourself

Use our handy submission guide to assist you with your submission, which provides comprehensive guidance on completing your Annual Submission.

Quick links to FAQs

We have updated our Knowledge Base. The Annual Submission folder now contains a comprehensive set of FAQs that cover a wide range of topics, from e@syFile errors to exporting Test and Live CSV files.

These resources are designed to help you navigate the submission process smoothly. In total, 58 Annual Submission FAQs are available to assist with any Tax Year-end related queries.

Visit the FAQs by opening your PaySpace application:

On the top right corner, click on your name > How We Can Help > at the bottom, select PaySpace Wisdom > Knowledge Base > FAQs > Annual Submission.

Below are some videos to assist with your submission process.

- Finalise the February run and close all the runs for the tax period

- Reconciling the EMP501

- Processing Corrections on an Interim Run

- Generate the Test CSV File

- Generate and validate the Live CSV File on e@syFile

Extended Support Hours

Please take note of our extended support hours during May:

- Saturday, 25 May, from 08:00 to 12:00

- Friday, 31 May, until 19:00

Annual Tax Submission Workshop

The PaySpace Payroll Annual Tax Submission Workshop will guide you through the process of completing the EMP501 reconciliation and generating the CSV Tax File for submission on e@syFile™ Employer.

There are 2 workshops available:

- 24 April 2024

- 9 May 2024

Public Holidays

1 May 2024 and 29 May 2024

Please note that PaySpace will be closed on 1 May 2024 and 29 May 2024 as we have Public Holidays in South Africa. Our offices will be closed on these days, but our support team will be available to assist you with any queries or concerns you may have on the following business days.

COIDA