The Rwanda Revenue Authority (RRA) introduced a new law establishing taxes on income, no. 027/2022 of 20/10/2022, published in the official gazette no 28/10/2022.

Article 56 of this law relates to the withholding tax on employment income and is effective 1 November 2022 as per the RRA’s announcement.

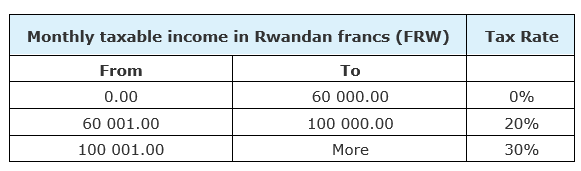

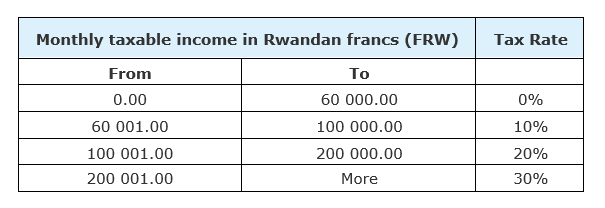

In Rwanda, a month-to-date tax method is applied for withholding taxes on employment income. There is no annual regularisation of taxation on employment income where an employee only earns employment income. Both tables below are therefore monthly tax tables.

- Table 1 applies from 1 November 2022 to 31 October 2023 and was implemented on the system accordingly.

- Table 2 applies from 1 November 2023 and was implemented on the system accordingly.

Click here for the official document.

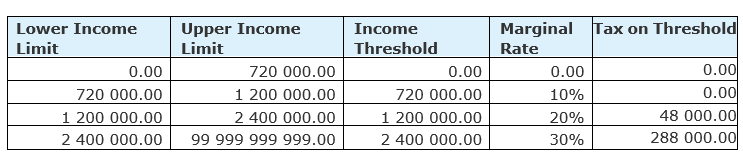

Annual Tax Tables

The new thresholds and rates, as set out below, are applicable from 1 November 2023.

Impact of the Rwanda Mid Year Tax Tables Update on PaySpace

- This change is effective 1 November 2023.

- All Rwanda payrolls will automatically recalculate when opening the first November run. If the November run is already open, customers must recalculate the payroll for the changes to take effect.

- All customers should have the Non-cumulative tax method selected on the Basic Company Information screen to circumvent two tax tables in one tax year.

- Please note that the Average tax method has been removed.

Should you have any questions regarding the Rwanda Mid Year Tax Tables Update, please feel free to visit our Support page for more ways to get in touch, or email us at [email protected]

The PaySpace Team