1. What is Payroll?

Payroll is the largest expense of an organisation and should be managed with attention to detail to pay employees accurately and on time.

The payroll division has the added pressure of legislative compliance as stipulated in the Income Tax Act and managed by the Revenue Authority. In addition, the company policies must be enforced considering the leave rules and onboarding procedures and adherence to reporting requirements for payroll funds such as Medical Aids and Retirement Annuities.

A fundamental understanding of the payroll requirements can assist with the planning of payroll functions. Incorrect or late payment of employees may result in an unhappy workforce which may lead to high staff turnover or cause a strike. The incorrect payment to employees may also result in the incorrect employees’ taxes being withheld resulting in tax penalties and interest. Ultimately, the incorrect or late payment of employees may affect business profits negatively.

There are various factors that impact payroll planning and processing. These factors include legislative requirements, company policies, and the employee contracts.

2. The Payroll Process

The payroll process runs in a weekly, bi-weekly, or monthly payroll cycle taking annual requirements into consideration. From employees being recruited to submitting the Annual Employer Reconciliation Declaration. Each of these processes is explained and enhanced with more information. An introduction to the process:

2.1 Recruitment of employees

Organisations identifies possible positions within the company to fulfill tasks that will contribute to achieving the strategic goals and targets outlined by the decision-makers.

The recruitment division will advertise the available positions on various platforms such as LinkedIn, Facebook or on their websites, to name a few examples. Applications are evaluated and suitable candidates are invited and invited for an interview.

2.2 Employment Contract

When Human Resources and the Head of the Department identifies a suitable candidate employee, the prospective employee is presented with an employment contract.

The Law of Contracts, Basic Conditions of the Employment Act (BCEA) and bargaining councils stipulates the minimum requirements for the employment contract.

2.3 Payroll Preparation

Planning annual, monthly bi-weekly and weekly payroll requirements will contribute to paying employees accurately and timeously. Included in the payroll planning a payroll processing closing date should be identified and clearly communicated to all colleagues in the business. All payroll input documents should reach the payroll division as per the communicated date to incorporate sufficient time for payroll reconciliation.

2.4 Payroll Processing

The payroll processing checklist includes:

- Prepare all the input documents for payroll processing

- Verify the payroll processing period

- Make the applicable configuration changes to the Payroll and HR solution

- Onboard new employees

- Process financial information

- Record leave transactions

- Reconcile payroll input

- Pay Employees

- Distribute payslips

- Provide the various divisions with required payroll reports

- Accomplish monthly statutory requirements

- Fulfill annual statutory requirements

2.5 Payroll Reports

The reports printed after the payroll processing is finalised and the payroll closed for further input, provides the financial department and the human resources department with the required information to complete journals and ledgers and to make informed business decisions.

These reports supply required information during internal and external audit processes where information is verified and investigated.

2.6 Third Party Payments

After employees are paid and the period-end payroll and hr reports are printed from PaySpace, third parties should be paid and notified of the member payment or contribution.

There are various types of third payments that can be recorded on the payroll:

- Retirement Funds

- Medical Aids

- Vitality

- ITA88 Notice (Agent Appointment Notification)

- Garnishee orders

2.7 Monthly Statutory Requirements

The Monthly Employer Declaration (EMP201) Report printed from PaySpace will display the Pay-As-You Earn (PAYE) amounts withheld, Unemployment Insurance Fund (UIF) withheld and contributed. Employment Tax Incentive (ETI) calculated amounts for qualifying employees employed by a qualifying employer are included on the EMP201. Skills Development Levies (SDL) contributed by employers for employees are represented on the EMP201 Report.

The amounts are paid to the South-African Revenue Services (SARS) by the 7th of the following month and the monthly return information submitted electronically through eFiling. The UIF submission is automated on PaySpace and the required information submitted to the Department of Labour.

2.8 Annual Statutory Requirements

Legislation requires employers to submit annual reports to governmental organisations such as the South African Revenue Service (SARS), Department of Labour and the Sector Education and Training Authority (SETA). To name a few examples of annual statutory reports

- Annual and Bi-Annual Employer Reconciliation Declaration (EMP501)

- Occupational Injuries and Diseases Report (OID)

- Sector Education and Training Authority Reports (Skills Development Reports)

- Employment Equity Reports

3. The Recruitment Process

For a business to grow optimally and achieve strategic goals it is crucial to employ the best suitable candidate for the available position.

Available Positions

Each company’s human resources division has a unique process that is followed to recruit an employee. Defining the organogram on PaySpace will indicate the positions or roles required for the business to function successfully and achieve business objectives.

A Position Specification Report can be download from PaySpace providing information that is important for the applicant:

- Job Title

- Purpose of the position within the organization

- Outline of the expected outcomes of the position

- Minimum qualifications and experience

- The date that the position needs to be filled

- Structure of remuneration

- Any special requirements for example proof of qualifications must be attached with the application, or if the position was earmarked as a BBBEE position

- Closing date for applications

Interview Process

The Human Resources division will work through the applications or make use of software applications to identify the best suitable candidates.

The interview process is different for the various positions and company requirements. For more skilled positions the process below is:

- Initial interview with Human Resources, to determine if the candidate employee will be a suitable with the company’s culture. The interview can be hosted at the office, through a virtual meeting or a telephonic conversation.

- Applicants may be required to complete assessments to

- Personality assessments

- Information processing assessments

- Ability to learn new concepts assessments

- Brain profiling assessments

- The third interview is held if the assessments indicate that the candidate employee will be a suitable fit within the organization. This interview will include human resources department, head of department, and reporting manager. For some roles the CEO will also be present in the interview.

The role of the human resources division in the third or panel interview is to warrant questions posed to the candidate employees are fair, and that similar questions are asked for all candidate employees. The division will assist management in making an informed decision to appoint a suitable candidate.

Offer of Employment

A suitable candidate employee is identified, the human resources division will present the candidate employee with an offer of employment. Legislation requires minimum information to be recorded in the proposed employment contract.

The candidate employee can accept or negotiate the offer of employment. After the human resources division receives a signed copy of the accepted employment contract, unsuccessful candidates are informed telephonically or through email about their application status. It is good business practice to encourage the unsuccessful candidates to apply again for available positions. Providing constructive feedback to the unsuccessful candidates can provide them with the necessary guidance in future employment applications.

Employee On-Boarding Process

The human resources division may inform the successful applicant of the expected schedule for the first day or first week. On the commencement date after the employee was welcomed the human resources team completes induction training. In the training session important information about the company is shared with the new recruit.

As part of the onboarding process from the HR division, the employee will complete forms/information that will greatly impact payroll. This will include personal employee detail, such as:

- Certified copy of identification

- Residential and postal address

- Emergency contact details

- Proof of banking detail

- Tax number and tax office

- Selected medical aid plan and beneficiaries

- Retirement fund contribution and beneficiaries

4. Payroll Processing

PaySpace supports payroll and HR divisions to process information swiftly and accurately.

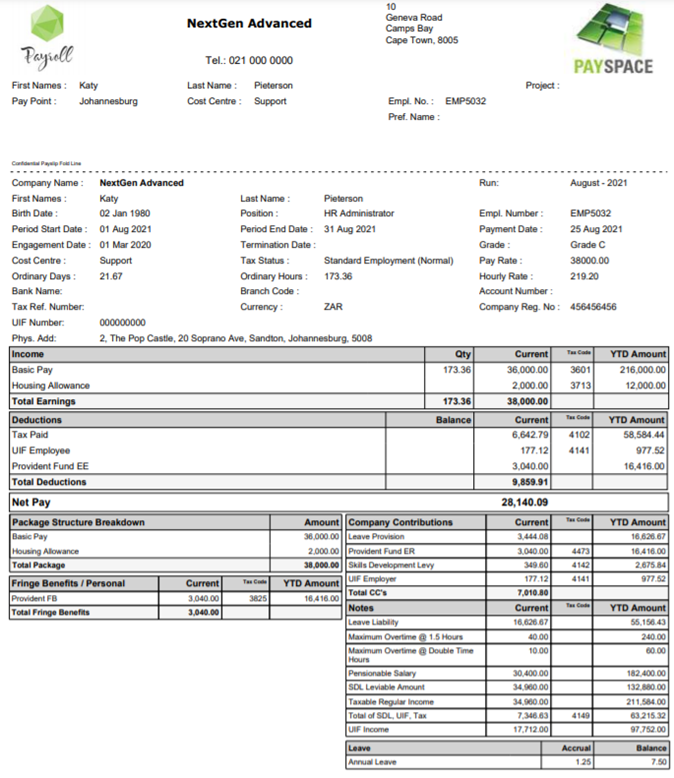

Payslips

For every payment from an employer to an employee, a payslip must be provided to the employee. Employees can be paid weekly, bi-weekly or every month. There are employees that receive payments twice or more a month.

For Example:

The Company pays net salaries on the 27th of the month and commission on the 10th of the following month. The employee will receive two payslips as two payments are made.

The Company pays annual bonus on the 15th of December and monthly salaries on the 27th of December. The employees will receive two payslips in December. The first payslip will be for the bonus payment and the second payslip for salaries.

Employees have an obligation to verify information printed on their payslips as specified in the legislation, including the authentication of PAYE an UIF amounts.

Ignorantia juris non excusat or ignorantia legis neminem excusat – ignorance of the law is no excuse.

Employees can check hourly or daily payments such as overtime when the hourly rate and additional working hours are visible on the payslip. Printing information such as loan balances for company loans or annual leave days due, will provide sufficient information to employees and result into less queries for the payroll and hr divisions.

PaySpace makes payslips available electronically for employees to download and print from their Employee Self Service Accounts. Employees always have their historical payslips available and can download the historical payslips to submit for applications such as loan applications.

Leave information that is available on Employee Self Service:

- Annual leave due at the beginning of the payment period

- Annual leave allocated during the payment period

- Annual leave taken within the payment period

- Annual leave due at the end of the payment period.

Payslip Example

Terminology

Refer to the below table for definitions and examples of payroll terminology

| Term | Definition |

| Income | Remuneration for work done, or to enable the employee to work

Examples:

|

| Deductions | Amounts withheld from the employee’s remuneration as prescribed by law or agreed upon in the employment contract.

Examples

|

| Fringe Benefits/Personal | Payment in kind.

Examples

|

| Company Contributions | Contributions made by the employer on behalf of the employee.

Examples

|

| Nett Pay | The final payment an employee receives for a specific period.

Earnings – deductions = nett pay |

Statutory Deduction: Pay As You Earn

PaySpace will calculate the employee PAYE accurately and as specified by the Income Tax Act. Various factors impact the tax calculation of an employee it is therefor important to record accurate detail when employees are onboarded onto payroll.

Statutory Deduction and Contribution: Unemployment Insurance Fund (UIF)

Employers must pay unemployment insurance contributions of 2% of the value of each worker’s remuneration per month. The employer and the worker each contribute 1%. Contributions are paid to the Unemployment Insurance Fund (UIF) or the South African Revenue Services (SARS) by the 7th of the following month.

The Unemployment Insurance Act and Unemployment Insurance Contributions Act apply to all employers and workers, but not to:

- workers working less than 24 hours a month for an employer;

- learners;

- public servants;

- foreigners working on contract;

- workers who only earn commission.

PaySpace calculates the amounts automatically and will exclude the applicable employees from the calculations as indicated by legislation.

Statutory Contributions: Skills Development Levies (SDL)

The SDL company contribution is imposed to encourage learning and development in South-Africa. The SDL contribution is only paid by the employer. PaySpace will calculate the Skills Development Levy based on the taxable remuneration of the employee.

5. Payroll Reports

Payroll reports executed from PaySpace assists the payroll and hr division to reconcile payroll processing that contributes to accurate employee payment. Payroll and hr reports are sent to the financial division to complete journals and ledgers.

PaySpace automatically sends the reports to the required division as soon as the payroll closed. The General Ledger information can be exported from PaySpace and imported into the applicable accounting software. The import file is a time-saving utility and eliminates typing errors.

Reports are used for internal and external audit processes to compare and investigate payroll processing information.

Payroll Processing Reconciliation

Payroll reconciliation reports are used to compare payroll input for the current pay period and must be generated before employees are paid to confirm the information processed reconciles wit the various input documents.

The table below indicates the types of reports that can be printed from PaySpace to assist in reconciling payroll input/values.

| Example of the report | Purpose of the report |

| Component Variance Report | The report compares financial information with the current and previous pay period.

Differences in fixed amounts must be explained. For example:

· Salary or Travel Allowance variances can be due to; = increases or decreases = new/terminated employees = pro-rated salaries for employees that did not work a full month

· Medical aid variances; = increase or decrease in medical aid dependants = change in medical aid plan options = new/terminated employees joined or departed the medical aid

· Pension fund variances; = increase or decrease in pensionable salary = new/terminated employees joined or departed the pension fund = Pension percentage contribution increased or decreased

· Use of company vehicle; = pro-rated use = employees received a different company vehicle to use = new employees received a company vehicle to use = terminated employees no longer use the company vehicle |

| Example of the report | Purpose of the report |

| Component Report | The report is used to reconcile all variable input of the period. At print time, the user must select earnings, deductions, company contributions and perks for which variable transactions were recorded.

For example, select to print commission and production bonus: Compare the totals printed with the totals of the input document.

If the totals reconcile, spot check a few employees to ensure the amounts reconcile.

If the totals do not reconcile, compare the values recorded on the payroll system with the values on the input documents per employee and correct the differences.

|

| Components Posted Units Reports | To display the hourly or unit input processed for the period. For example, overtime hours, unpaid leave days, public holidays, reimbursive km’s etc.

The hourly or unit input report is compared with the payroll document for reconciliation. |

| Leave Balances Reports | The Leave report will display the leave days of the employee at the beginning of the period, leave allocated for the period, leave taken during the period and leave balances at the end of the period.

Compare the leave taken amounts on the payroll system with the approved leave forms to reconcile leave processing.

PaySpace Employee Self Service allows for employees to apply for leave online and the required managers to approve or decline the leave transactions. Improving efficiency and supporting innovation. |

Payroll period end reports

The payroll processing reconciliation is completed with the payroll reports balance with the input documents received. After employees are paid and the payroll closes the payroll reports for the payment run are automatically emailed to the specified divisions.

PaySpace allows users to print historic reports from the current pay month, this feature is of great value during internal and external purposes. As a cloud-native payroll the data is always available to the approved PaySpace users.

The below table includes examples of these reports:

| Example of the report | Purpose of the report |

| Payroll Reconciliation Report – Totals | The report displays the totals per allowance, deduction, company contribution and perk for the period.

For larger companies the report is helpful to track and plan the employee cost per division within the organisation. The report provides totals for each department per earning, deduction, company contribution and perk. |

| Nett Payment Listing | A report that displays the nett pay of the employee and the method of payment, as employees may be paid by cheque, cash or electronic transfer.

The account particulars of employees paid through electronic transfer display on the report. This report is compared with the bank report to reconcile the total nett pay paid over to employees and to monitor possible fraudulent activity. |

| Payroll Register Report | The report displays a short summary of each employee’s payslip for record-keeping purposes and to assist employees with payroll queries. |

| Leave Balances Report | The report is used for record-keeping purposes and to assist with employee enquiries.

For each type of leave and employee is entitled to, the report displays:

|

| Components Report | The report assists to accurately pay third parties and submit amounts deducted and contributed for medical aid, pension or provident fund, garnishee orders etc. |

| EMP201 | To pay the amounts deducted and contributed for PAYE, UIF and SDL to SARS. |

| UIF Declaration File | The declaration file is automatically emailed to the Department of Labour and contains all the required information per employee that accompanies the amounts deducted and contributed. |

Should you have any questions regarding this change, please feel free to visit our Support page for more ways to get in touch, or email us at [email protected].

The PaySpace Team