The Council of Ministers, under the chairmanship of the President of the Republic on 11 October 2023 examined and adopted 7 decrees to accelerate the process of implementing the Universal Health Insurance.

The universal health coverage was enshrined by Law No. 2021-022 of October 18, 2021 establishing Universal Health Insurance in the Togolese Republic. The Universal Health Insurance “l’Assurance Maladie Universalle” (AMU) will ensure all residents have access to health care. The system consists of two tiers:

- Public and private employees are covered by the compulsory scheme “Régime d’Assurance Maladie Obligatoire de base” (RAMO).

- The poor and other individuals on public assistance are covered by a separate system “Régime d’Assistance Médicale” (RAM).

The Universal Health Insurance will be managed by the National Health Insurance Institute (INAM) and the National Social Security Fund (CNSS). The current mission as the management body for health insurance for all public and civil employees remains with the National Health Insurance Institute (INAM). In parallel, the National Security Fund (CNSS) will be responsible for the administering of the health insurance for the private sector employees, self-employed individuals, and ministers of religion.

Decree No 2023-096/PR sets the rates, amounts and methods of recovery of the Compulsory Universal Health Insurance Scheme (RAMO) contributions effective 1 January 2024.

The contribution base for the Compulsory Health Insurance Scheme (RAMO) defined in Article 9-11 of the decree:

- Article 9: The contribution base for salaried workers is the basic salary and all taxable bonuses and allowances, excluding reimbursements of expense and family benefits.

- Article 10: The amount of remuneration to be taken into account for the calculation of contributions cannot be lower than the amount of the Guaranteed Interprofessional Minimum Wage (SMIG).

- Article 11: If a worker is employed in the service of several employers, each of them is responsible for the payment of the calculated share of contributions in proportion to the remuneration he pays to the person concerned.

Contribution rate for the Compulsory Health Insurance Scheme (RAMO) health insurance is prescribed in Article 12 of the decree:

Article 12: The contribution rate owed by salaried workers under the Compulsory Health Insurance Scheme (RAMO) is set at 10% of monthly remuneration subject to the contribution, of which at least 50% is payable by the employer and the rest is borne by the worker.

Click here for the Decree No 2023-096/PR.

Impact of the Togo Universal Health Insurance on PaySpace

- The new Assurance Maladie Universelle deduction and company contribution components have been implemented on the system effective 01 January 2024.

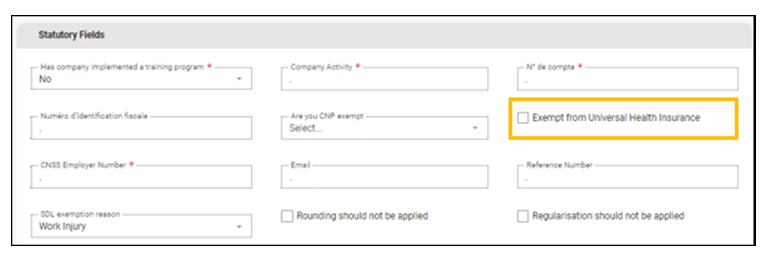

- A new custom field has been created on the Basic Company Information screen: Exempt from Universal Health Insurance – if the field is activated, the Assurance Maladie Universelle calculation will not be calculated for all employees.

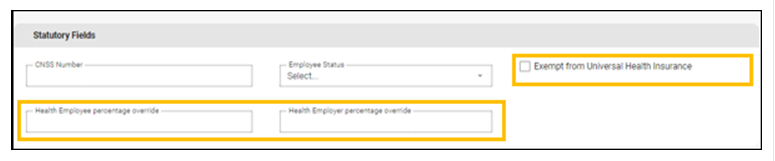

- A new custom field has been created on the Employee Basic Profile screen: Exempt from Universal Health Insurance – if the field is activated, the Assurance Maladie Universelle calculation will not be calculated for the selected employee.

- For flexibility, the employee and employer contribution percentages can be overriden using the fields created on the Employee Basic Profile screen:

Ensure that the total percentages captured for employee and employer do not exceed 10%.

- Refer to the Release Note #602531 for instructions on how to configure flexibility of the Universal Health income base using the Component Taxablity screen.

- All Togo customer payrolls have been recalculated.

Should you have any questions regarding the Togo Universal Health Insurance, please feel free to visit our Support page for more ways to get in touch, or email us at [email protected]

The PaySpace Team