Multi-currency payroll in 40+ African countries, Brazil, the UK and UAE.

Deel Local Payroll offers local or multi-country, multi-currency and multi-language payroll solutions for 40+ African countries, Brazil, the United Kingdom and the UAE.

Looking for your payslip? You are in the wrong place.

Head to the Employee Self Service portal:

Register or reset your password or login here,

alternatively contact your HR team.

Trusted by 17,000+ customers across 45+ countries. Support NPS 97. Powered by PaySpace. Backed by Deel.

Payroll that's built to scale with you

With seamless integrations, real-time reporting, and mobile-first access for employees, you get a single platform to manage payroll and your people.

Always on access to your data

Our secure, cloud-native platform keeps your payroll running, whether you have one location or operate across multiple countries. Automate tax, compliance, and reporting in over 45 countries, with legislative updates applied automatically.

Expatriate payroll solutions

Ensure your expatriate employees stay fully compliant in both home and host countries.

Automated gross-up calculations simplify complex tax equalisation, saving time and reducing risk.

Tax compliance

Through our extensive network, Deel Local Payroll ensures local tax compliance and accuracy for any payroll, automatically applying legislative updates and managing filings with authorities like SARS, HMRC, and eSocial, reducing the risk of penalties or missed deadlines.

Payroll simplified

Unify payroll across multiple countries with one secure, cloud-native platform.

Deel Local Payroll automates compliance, tax, and reporting across 40+ African countries, Brazil, the UK and the UAE, ensuring accuracy, scalability and real-time legislative updates.

Key benefits of Deel Local Payroll

Out-of-the-box configuration

A single-instance, multi-tenant platform delivering secure, scalable configuration with built-in tax and legislative updates and continuous compliance tracking.

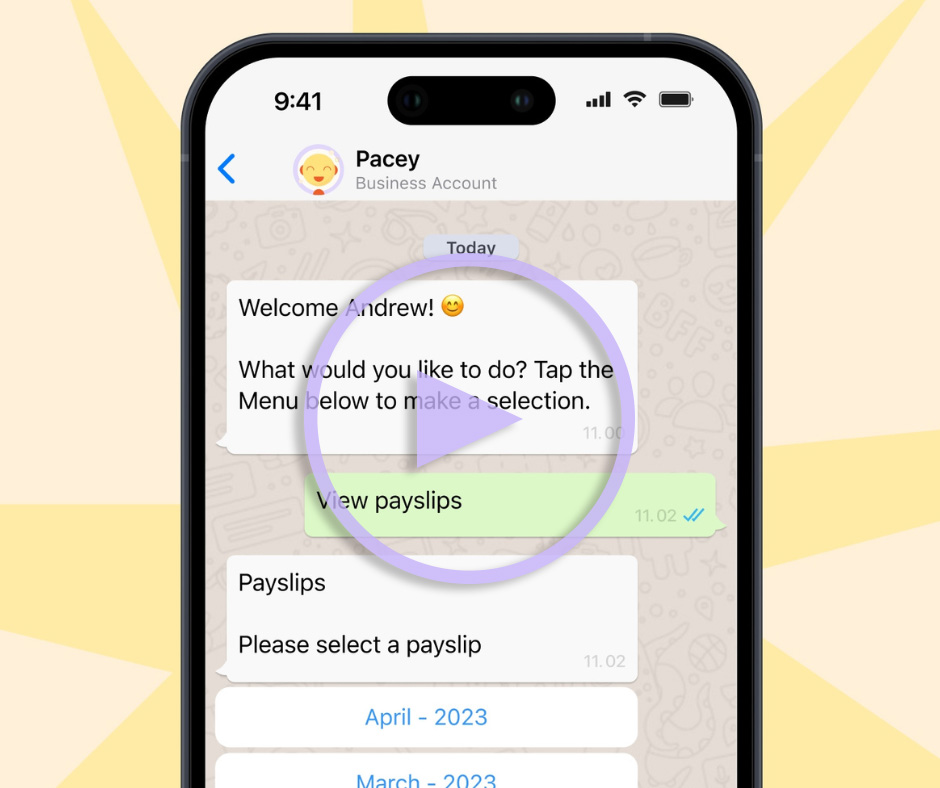

Mobile-first experience

Employees can access payslips, apply for leave, download tax certiticates and submit claims directly via desktop, mobile or WhatsApp (add-on module).

Enterprise-grade security

SOC 1 & 2, ISO27001, GDPR, POPIA, and LGPD certified, with role-based access and full audit logging.

Pay-per-employee per month

Choose the pay run frequency that fits your business. There are no annual license or hidden software fees and you only pay per employee, per month, regardless of how often you run payroll.

Audit-ready payroll intelligence

Create custom dashboards and generate audit-ready reports, analyse payroll data and workforce trends based on your unique business requirements without manual number crunching. Export GL-ready data for your finance team.

Flexible payroll integrations

Integrate with Workday, and leading accounting platforms. With comprehensive API documentation and webhook support, you can build your own integrations (pushing or pulling data) or embed payroll functionality directly into existing systems.

Rethink the way you run payroll

Perfect for teams hiring fast or expanding across multiple regions

Securely upload, download, and track all your payroll files.

Secure, compliant payroll - without the risk on you

Payroll isn’t just admin - it’s financial intelligence

WhatsApp employee self-service for payroll and HR tasks

Global coverage and local expertise

All statutory calculations and reports are handled automatically. We cover the cost of confirming and updating every legislative change through our five-tier advisory process. Our compliance team regularly reviews each country setup and keeps public holidays and medical aid tables up to date.

- Angola

- Benin

- Botswana

- Brazil

- Burkina Faso

- Burundi

- Cameroon

- Chad

- Congo

- Democratic Republic of Congo (DRC)

- Egypt

- Equatorial Guinea

- Eritrea

- Eswatini

- Ethiopia

- Gabon

- Gambia

- Ghana

- Guinea Conakry

- Ivory Coast

- Kenya

- Lesotho

- Liberia

- Madagascar

- Malawi

- Mali

- Mauritania

- Mauritius

- Morocco

- Mozambique

- Namibia

- Niger

- Nigeria

- Rwanda

- Senegal

- Sierra Leone

- South Africa

- Tanzania

- Togo

- Tunisia

- Uganda

- United Arab Emirates (UAE)

- United Kingdom

- Zambia

- Zanzibar

- Zimbabwe

Explore the right payroll and HR edition for your business.

Lite Edition

Seamless, low-complexity payroll for businesses up to 50 employees. Get essential payroll, done right.

- Unlimited interim payslip runs

- Tax and compliance dashboard (HMRC, SARS, eSocial & OTHER local authorities)

- Automated statutory leave pay

- Essential pre-defined reports and country-specific statutory reports

- Tax configuration aligned with legislation for businesses operating in a single country

- eOnboarding (SA, more countries launching soon)

- Employee self-service for payslips, leave requests, personal details, and tax certificates

- General ledger configuration

- Mock payslip generator

- Role-based security

- Single level organisational structure

- Automatic medical scheme rate updates (SA)

- Automated UIF submission (SA)

- Audit tracking

Premier Edition

The perfect fit for growing businesses that need advanced reporting, and multi-entity management.

- Includes everything in Lite, plus:

- Comprehensive reports

- Tax configuration aligned with legislation across multiple countries

- Third-party payment files

- Expense claims: single level approver

- Multi level organisational structure

- Built-in file attachments

- Email notes and reminders to employees and managers

- Incident and asset management

- Advanced position management and leave configuration

- Sandbox environment

- Equity reporting (SA and Namibia)

Master Edition

Designed for large or multi-national organizations demanding high-complexity features, extensive automation, and global scale.

- Includes everything in Premier, plus

- Advanced workflows with multi-level approval processes

- Integrated recruitment platform from job post to onboarding

- Dynamic, auto-generated organisational charts

- Automated retro-active salary calculations

- Multi-currency payment files via the expat module

- Automated tax equalisation for expat payroll

- Custom fields and forms

- Report writer

- Consolidated reporting across all regions

Optional Add-On Modules

Explore additional modules to extend your payroll capabilities

- WhatsApp Employee self-service

- TymeAdvance (South Africa)

- Workforce Planning

- Performance Management and Succession Planning

- Cloud Analytics / Power BI

- Onboarding & Requisition

- Org Charts & Talent Visualisation

- Recruitment & ATS

- Expat Management - Multi-currency

- Workday Connector (GPC Certified)

Outsourcing

We take care of it all.

- Full-service payroll management, including compliance with tax and legislative updates, accurate submissions, and secure employee payments, handled entirely by our experts.

“There are no headaches for our IT team. We don’t have to schedule manual updates or worry about compliance changes being missed. It all happens automatically—in real time.”

Alison Boruchowitz – Head of People and Organization

PUMA South Africa

550

Employees across South Africa

Awards & Recognition

Whether your business needs are to manage payroll or HR or both, we have a software solution for you that is accessible anytime, anywhere and from any device.

Winner: Transformation Project of the Year 2024

Winner: Payroll Innovation Award 2023

Winner: Payroll

Software Supplier of the Year 2019

Top 25 HR Software

Award 2019

Finalist:

The SaaS Awards 2019