Automated payroll solutions for UK businesses.

Discover Deel Local Payroll, powered by PaySpace, your cloud-native payroll solution that automates payroll calculations, simplifies reporting, and ensures compliance with UK laws.

Join over 16,000+ customers across 45+ countries who trust Deel Local Payroll.

Looking for your payslip? You are in the wrong place.

Head to the Employee Self Service portal:

Register or reset your password or login here,

alternatively contact your HR team.

Join 16,000+ customers running payroll locally

Why UK businesses choose Deel Local Payroll

Our platform molds automatically to UK payroll legislation, taking the complexity out of compliance and monthly processing. With direct HMRC integrations and built-in support for statutory requirements, Deel Local Payroll gives payroll managers confidence, accuracy, and efficiency every single month.

Fully HMRC compliant

Stay ahead of changing legislation with automatic tax updates, RTI submissions, and accurate PAYE, NI, and pension deductions. No manual tracking or missed deadlines.

Real-time payroll accuracy

Run payroll with confidence using real-time gross-to-net calculations and automated adjustments for mid-month changes, reducing admin time.

Scalable, self-serve payroll

From SMEs to enterprises, scale effortlessly with pay-per-employee pricing, built-in HR integrations, and free onboarding for small teams.

Audit-ready payroll & secure record keeping

Meet HMRC requirements with confidence. Deel Local Payroll automatically generates compliance reports, maintains a full audit trail of filings and payments, and ensures secure record-keeping.

Integration in the UK

Key benefits of Deel Local Payroll

Seamless RTI integrations

Submit FPS, EPS, and NVR reports directly through our RTI dashboard. Code notices are retrieved automatically, with ExB reporting included for complete HMRC compliance.

Automated tax code assignment

Use HMRC starter checklists for accurate and automatic tax code assignment, minimizing risk and reducing admin.

Streamlined leave management

Track and calculate statutory leave entitlements with ease, including HMRC-ready reporting for sick, maternity, paternity, shared parental, bereavement, and adoption leave.

Secure BACS payments

Generate compliant BACS files directly from Deel to pay employees via your banking platform without manual rework.

Automated statutory leave pay

Automatically calculate average weekly pay for all supported statutory leave categories (sick, maternity, paternity, shared parental, bereavement, adoption, and neo-natal).

Essential UK reports

Generate critical statutory reports including P60s, P45s, P30, P32, and Apprenticeship Levy submissions.

HMRC payments screen

Access a consolidated view of employer liabilities, with a robust dashboard to manage amounts due before paying HMRC.

Pension auto enrolment

Automate the assessment and enrolment of employees into pension schemes, ensuring ongoing compliance without manual intervention.

Expert guidance and strategic solutions

Professional services and consulting

Get tailored consultancy for your UK business. Our seasoned professionals offer strategic guidance and innovative solutions to drive success in the dynamic British market.

We know the ins and outs of local regulations and industry needs, providing tailored strategies for everything from audits to project management and optimisation.

Tackle challenges head-on and open new opportunities to reach your business goals with confidence.

Looking for your payslip? You are in the wrong place.

Head to the Employee Self Service portal:

Register or reset your password or login here,

alternatively contact your HR team.

Best-in-class payroll management solutions

Outsourced payroll specialists

Looking for your payslip? You are in the wrong place.

Head to the Employee Self Service portal:

Register or reset your password or login here,

alternatively contact your HR team.

Explore the right payroll and HR solution for your business

Lite Edition

- Cloud-native software

- Real-time calculation engine

- Basic statutory reporting

- Automated processing of HMRC coding notices

- Automated mid-month changes

- Unlimited pay runs

- Bacs payments

- 100+ essential reports

- Built-in security roles

- Employee and manager self service

- Only pay for active employees

- QuickBooks and Xero integration

- Local support

- Sandbox environment

Premier Edition

- Everything in Lite +

- API integrations

- Bulk uploads

- Basic approval workflows

- Auto schedule reports.

- Multi-level GL configuration.

- Comprehensive reports

- Build your own custom fields & forms

- Expense claims: one approver

- Automated P11D support

- Expense claims: one approver

Master Edition

- Everything in Premier +

- Multi currency payment file

- Custom fields and forms

- Custom report writer

- Build your own custom payslip

- Retro active calculations

- Advanced, multi-step, approval workflows

- Complex, multi-country configurations

- Expat gross up currency conversions

Bureaus & Accountants

- Cloudroom (secure client communication)

- Process orchestration tool

- Local support team in the UK

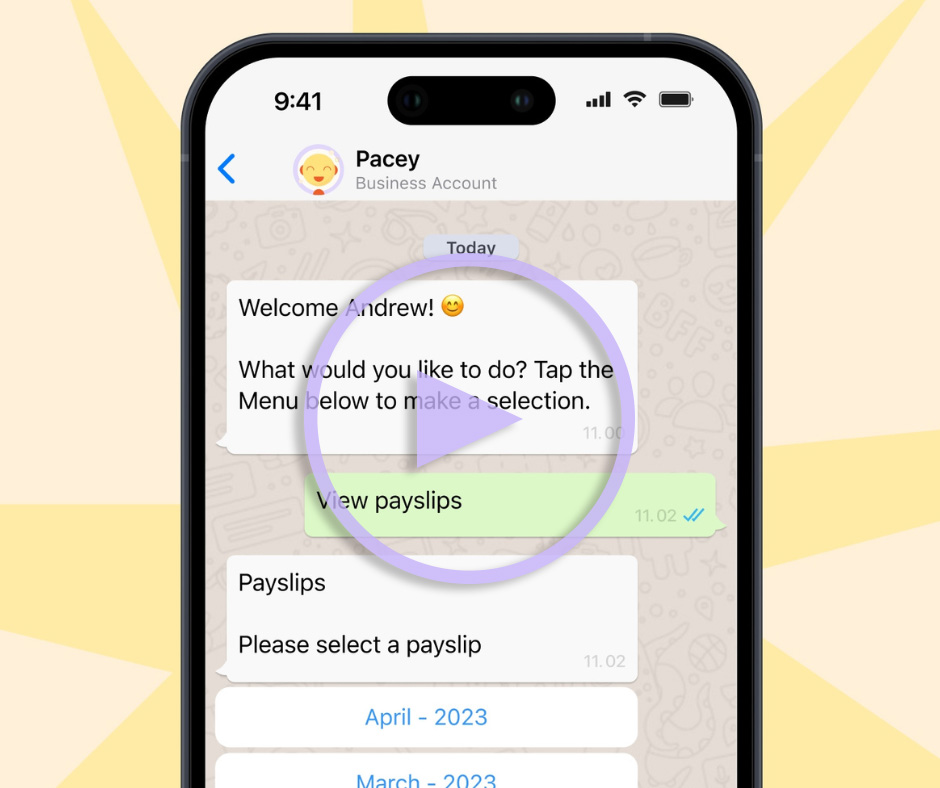

- WhatsApp employee self-service

- Unlimited number of users

- Phone support

- Pay per employee - based on actual consumption

- Discounts available based on volume and growth

Optional add-on modules

- WhatsApp employee self-service

- Power BI and Cloud analytics

- Recruitment and OrgChart

- Workday connector

- Priority support

- White-label our solution (for payroll bureaus and accountancy firms)

- BPO payroll processing by experts and industry specialists. Contact us for pricing

- Whether you run payroll weekly, fortnightly or monthly, you pay a flat fee per employee per month

- T&Cs apply based on your business requirements

Maximise your software experience

Expert Payroll and Compliance Training

Our hands-on sessions offer practical guidance and expert tips to navigate payroll challenges and stay on top of UK regulations. Whether you’re new or a seasoned pro, our training will help you fine-tune your payroll processing and get the best out of the software.

Looking for your payslip? You are in the wrong place.

Head to the Employee Self Service portal:

Register or reset your password or login here,

alternatively contact your HR team.

WhatsApp employee self-service for payroll and HR tasks

“There are no headaches for our IT team. We don’t have to schedule manual updates or worry about compliance changes being missed. It all happens automatically—in real time.”

Alison Boruchowitz – Head of People and Organization

PUMA South Africa

550

Employees across South Africa

Awards & Recognition

Whether your business needs are to manage payroll or HR or both, we have a software solution for you that is accessible anytime, anywhere and from any device.

Winner: Transformation Project of the Year 2024

Winner: Payroll Innovation Award 2023

Winner: Payroll

Software Supplier of the Year 2019

Top 25 HR Software

Award 2019

Finalist:

The SaaS Awards 2019