The General State Budget (OGE) for 2024 was approved by National Assembly, in Luanda, on 13 December 2023 and enacted on 26 December 2023.

According to the Ministry of Finance, the amendments to the 2024 Economic Year (OGE-2024) appears in Law No. 15/23, of 29 December 2023 (OGE-2024 Law), and in all its annexes. The Law is effective from 1 January 2024.

The following tax measures affects payroll in Angola for the 2024 tax year:

- Article 20 amends the Employment Income Tax Code (Imposto sobre os Rendimentos do Trabalho) – income earned up to a limit of Kz 100,000 is exempt from IRT.

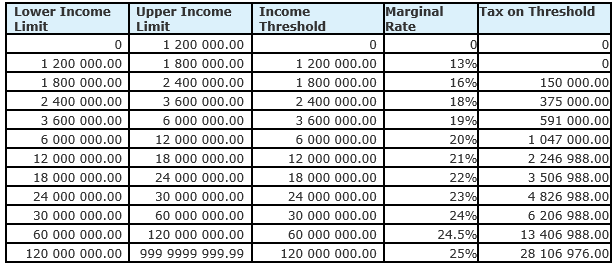

- This amendment includes revised individual income tax (IRT) brackets for the 2024 tax year.

- The zero-rated bracket increases from Kz 70 000 to Kz 100 000.

- The 10% bracket of Kz 70 000 to Kz 100 000 is removed.

Click here for the Law no 15/23 OGE 2024.

New Tax Tables

Annual Tax Tables effective 01 January 2024:

Impact of the Angola Amendment to Employment Income Tax Code on PaySpace

- The new tax tables have been implemented on the system effective 01 January 2024.

- All Angolan customer payrolls have been recalculated.

- No other statutory changes have been announced.

Should you have any questions regarding the Angola Amendment to Employment Income Tax Code, please feel free to visit our Support page for more ways to get in touch, or email us at [email protected]

The PaySpace Team